The Dow plunge isn't anywhere near done. At least, not according to chief financial officers at major corporations.

More than half of the members of the CNBC Global CFO Council think the Dow Jones Industrial Average will fall below 23,000 — roughly 2,000 points from its current level — before the stock market barometer is ever able to top the 27,000 level. The 23,000 level would equate to another 8 percent in decline among the Dow group of stocks before the selling stops. The Dow dropped by more than 400 points on Monday.

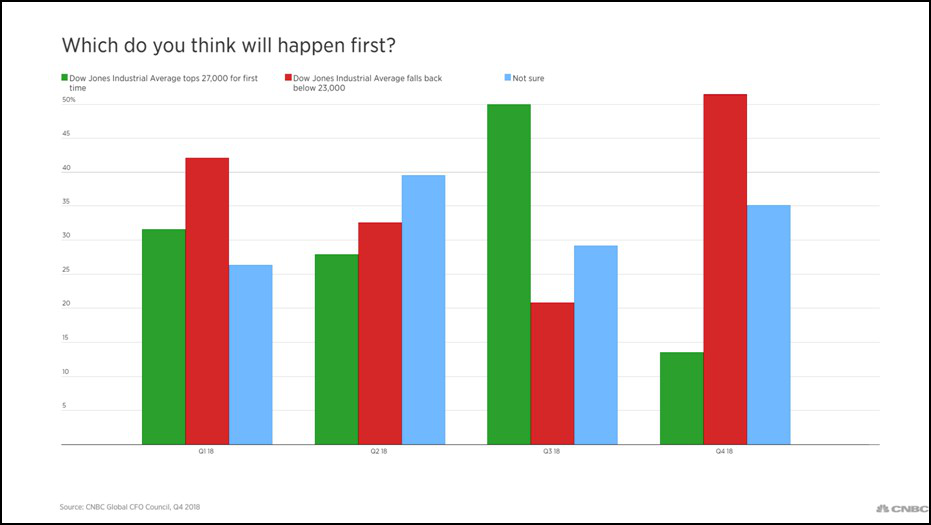

Just over 51 percent of CFOs taking the survey have come to this pessimistic view of stocks, which represents a high in the CNBC quarterly CFO survey for 2018. When stock market volatility first spiked in Q1, 42 percent of CFOs thought a drop to 23,000 was coming. But 31 percent of CFOs were still of the mindset that a new record above 27,000 was more likely, and the market optimism increased by the third quarter to 50 percent of CFOs believing 27,000 was possible.

Now only a little more than 13 percent of financial officers believe the market will reach a new record before another major drop.

Trade is the No. 1 concern

Concerns about a slowing economy — Goldman Sachs said on Monday in a report that U.S. economic growth could be cut in half by the end of next year as the tax cuts wear off and rates rise — and worries about another round of tariffs against China set for January in the ongoing trade war are weighing on the corporate outlook.

Thirty-five percent of CFOs surveyed in Q4 cited trade as their biggest current concern, making it the top issue in the fourth quarters.

Reference: CNBC