With sentiment souring and a global equities rout on Tuesday, risk averse traders sought shelter in the liquid dollar, which climbed from a two-week low hit earlier on Tuesday.

The dollar index, measuring performance against six major peers, was steady at 96.82 on Wednesday. The index gained 0.65 percent in the previous trading session.

· The yen traded at 112.91, with the greenback gaining 0.14 percent. The yen hit its highest level this month on Tuesday at 112.29per dollar before losing steam as dollar bulls took charge.

· The euro traded with a weak bias at $1.1372. The single currency lost 0.7 percent of its value on Tuesday.

The British pound was little changed at $1.2786, having lost 0.5 percent versus the greenback on Tuesday. The pound is seen likely to trade sideways until the market gets more clarity on progress in the Brexit deal.

· JP Morgan economists expect economic growth to slow down in 2019, to a pace of 1.9 percent for the year.

The economist say the slow down from a "boomy" 3.1 percent in year-over-year fourth quarter growth will come as fiscal, monetary and trade policy get less supportive or more restrictive.

· Analysts at JP Morgan offer their take on the Fed rate hike plans and the US dollar for the coming year.

Key Highlights (via Reuters):

Look for 4 hikes in 2019.

Do concede there is a risk of fewer hikes but don't elaborate on this much.

On the USD:

See it higher in the first half of 2019, only moderately so.

For H2 they see it falling slightly.

· The ECB won’t be deflected by the Italian political and budget drama and will raise interest rates next year, a economics firm has predicted.

Capital Economics said that as long as the eurozone keeps growing the ECB will not delay the ending of its cheap money policy of bond buying known as quantitative easing because as yet there are “no signs that Italy is derailing the eurozone economy”.

· As reported by Reuters, Wednesday will see the European Commission begin to take its first steps in punishing Italy for violating EU terms in their 2019 budget.

Key quotes

Around noon (1100 GMT), it (the Commission) will publish its opinions on the drafts of all the 19 countries sharing the euro, including that of Italy’s eurosceptic government, which has been revised only slightly from the version the EU executive rejected in October.

The Commission will therefore also publish a report that Italy is in breach of the EU law that says public debt cannot be higher than 60percent of GDP, or, if it is, has to be falling towards 60 percent at a satisfactory pace.

· British Prime Minister Theresa May arrives in Brussels on Wednesday to attempt to agree a blueprint of Britain’s post-Brexit ties with the European Union, which the bloc’s diplomats said was being held up by disagreements over Gibraltar, fisheries and trade.

All EU leaders are due to meet on Sunday to rubber-stamp the Brexit deal, consisting of Britain’s withdrawal agreement and an outline of the two sides’ new relationship after Britain exits the EU.

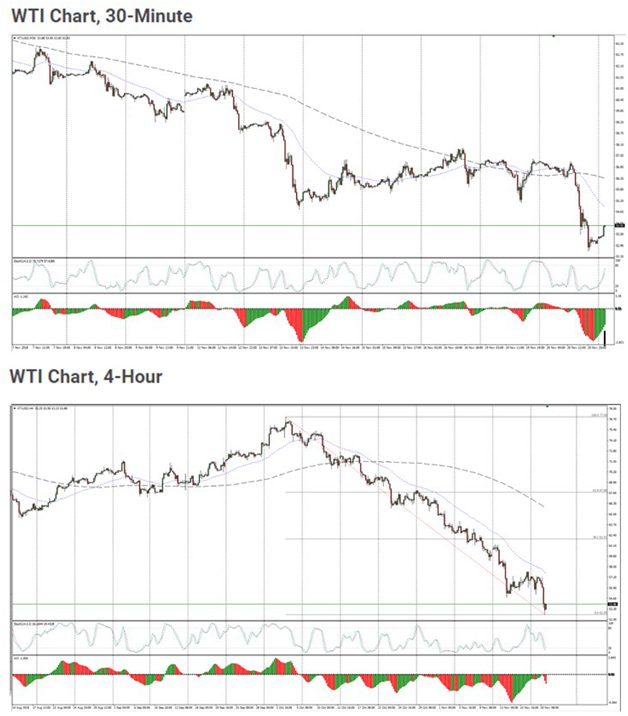

· Oil bounced by more than 1 percent on Wednesday to claw back some of the previous day’s 6-percent plunge, lifted by a report of an unexpected decline in U.S. commercial crude inventories and record Indian crude imports.

International Brent crude oil futures LCOc1 were at $63.39 per barrel at 0747 GMT, up $86 per barrel, or 1.4 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude futures CLc1, were up 90 cents, or 1.7 percent, at $54.33 a barrel.

Wednesday’s rebound came after a report by the American Petroleum Institute late on Tuesday that U.S. commercial crude inventories last week fell unexpectedly by 1.5 million barrels, to 439.2 million, in the week to Nov. 16.

Record crude imports by India of almost 5 million barrels per day (bpd) also supported prices, traders said.

WTI's last quarter has seen a complete reversion into a bearish trend, and even a bounce into the 62.00 region would see US crude still stuck in a bearish chart stance after tumbling for what is now set to become a seven-week bear ru

· Goldman Sachs said in a note on Wednesday that it expects oil markets to remain highly volatile in the coming weeks.

“It will take a fundamental catalyst for prices to stabilise and eventually trade higher,” Goldman said in the note, adding that such a catalyst would include physical evidence that OPEC production is “sequentially” declining and further proof of demand resilience.

Reference: Reuters, CNBC