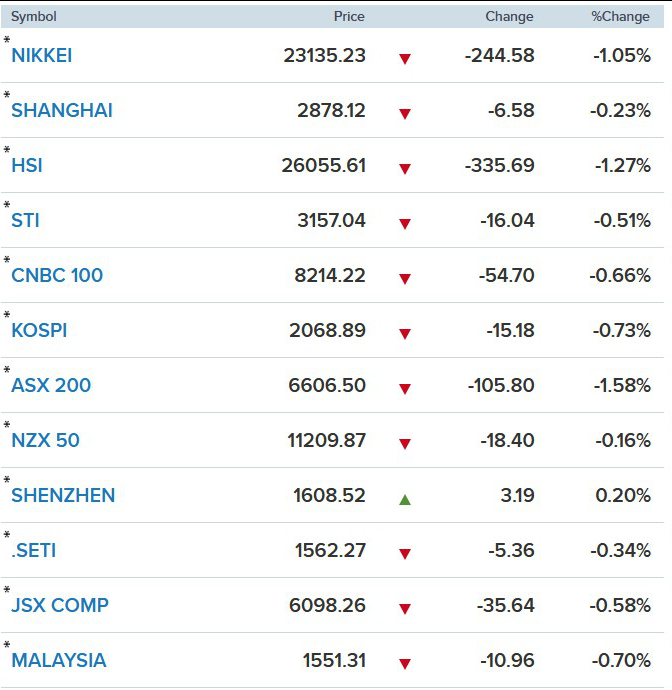

· Stocks in Asia mostly slipped on Wednesday after U.S. President Donald Trump said overnight that he may delay a trade deal with China till after the 2020 U.S. presidential election.

Shares in Australia led losses among the region’s major markets, with the S&P/ASX 200 declining more 1.58% to close at 6,606.50 as shares of major miner BHP plunged 2.49%.

The Australian economy grew 1.7% on a seasonally adjusted basis year-on-year in the September quarter, data from the Australian Bureau of Statistics showed on Wednesday.

In Japan, the Nikkei 225 fell 1.05% to close at 23,135.23 as shares of index heavyweight Fast Retailing plummeted 5.21%. The Topix index also declined 0.2% to end its trading day at 1,703.27.

Mainland Chinese stocks were mixed on the day, with the Shanghai composite down 0.23% to about 2,878.12 while the Shenzhen component was up 0.31% to 9,687.95. The Shenzhen composite also rose 0.199% to approximately 1,608.52. Hong Kong’s Hang Seng index declined 1.16%, as of its final hour of trading.

South Korea’s Kospi ended its trading day 0.73% lower at 2,068.89, as shares of chipmaker SK Hynix fell 1.27% — following overnight declines of Nvidia, Micron and Advanced Micro Devices on Wall Street.

Overall, the MSCI Asia ex-Japan index traded 0.84% lower.

· Japanese shares tumbled on Wednesday as comments from U.S. President Donald Trump and a U.S. House bill targeting camps for Muslims in Xinjiang reignited fears a trade deal between Washington and Beijing may not come through.

Renewed concerns about the global economic outlook also prompted investors to shift funds from global cyclicals to domestic-demand oriented shares.

The Nikkei 225 index skidded 1.05% to 23,135.23, closing below its 25-day moving average of 23,255, a key technical support, for the first time in almost two months.

The broader Topix lost 0.20% to 1,703.27 but , advancing shares outnumbered decliners by a ratio of 57 to 43 in an unusual twist.

“I think the Uighur bill is far more significant than Hong Kong bill for China. The U.S-China trade talk is breaking down,” said Hiroaki Hayashi, managing director at Fukoku Capital.

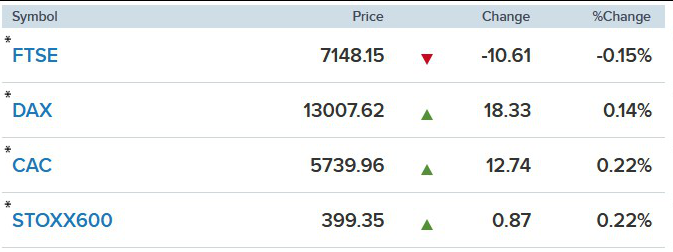

· European stocks opened slightly higher Wednesday morning, as investors awaited a fresh batch of economic data.

The pan-European Stoxx 600 was up around 0.1% during early morning deals, with most sectors and major bourses in positive territory.

Market focus is largely attuned global trade developments after President Donald Trump said a limited trade agreement with China might have to wait until after the 2020 presidential election.

Reference: Reuters, CNBC