· The S&P 500 as caused a lot of issues for traders during the trading session on Thursday as we go back and forth. We are waiting for the jobs number to come out on Friday, and that of course always makes the market a little bit choppy. That being said, I believe it is only a matter of time before we see this market make a move, but it probably won’t be until the announcement comes out at 830 in the morning on Friday in New York. Pullbacks at this point should be buying opportunities with the 50 day EMA underneath should offer plenty of support.

Ultimately, this is a market that is in an uptrend and it should be treated as such. With that being the case I like the idea of buying any types of dips, as a knee-jerk reaction to the jobs figure should be a value proposition just waiting to happen. The 3030 level underneath begins a significant amount of support that extends all the way down to the 3000 handle. Ultimately, we are about to see the “Santa Claus rally” start taking off again. Ultimately, this is a marketplace that is one that cannot be shorted, because quite frankly this is a market that is far too bullish and of course with the Federal Reserve on the sidelines willing to help Wall Street, there’s hardly any way to start fighting this type of trend. In fact, the market participants will continue to look for value going forward.

· Asian stocks gained on Friday as investors took heart from U.S. President Donald Trump saying trade talks with China were “moving right along”, and U.S. oil prices sat near 2-1/2-month highs after OPEC and other producers areed to cut output.

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.5%.

“Many players have taken a wait-and-see attitude given a lack of fresh trading cues ahead of U.S. paryolls data and the Federal Reserve’s policy meeting. But clearly, the mood is quite positive,” said Yasuo Sakuma, chief investment officer at Libra Investments.

· Japanese shares closed higher on Friday, a day after its government approved a 26 trillion yen ($239.32 billion) stimulus package to support growth, with the focus shifting to U.S. jobs data that will be out later in the day.

The Nikkei index ended up 0.23% to 23,354.40, buoyed by gains in industrial and financial sectors. The benchmark rose 0.26% this week — its second weekly gain.

· China stocks ended higher on Friday, posting their biggest weekly advances in nearly two months, buoyed by a series of upbeat economic data and hopes of a proposed Sino-U.S. trade deal.

The blue-chip CSI300 index rose 0.6%, to 3,902.39, while the Shanghai Composite Index added 0.4% to 2,912.01.

For the week, CSI300 was up 1.9%, while SSEC gained 1.4%, both their largest weekly gains since the week of Oct. 11.

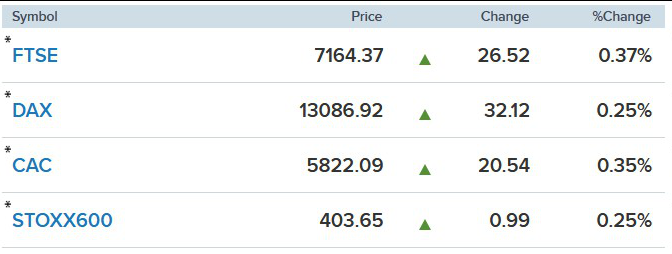

· European stocks are set to open higher Friday morning as investors await employment data out of the U.S. and monitor trade developments between Beijing and Washington.

The FTSE 100 is seen up by 19 points at 7,156; the CAC 40 is expected to start higher by 24 points and the DAX 30 is set to open higher by 64 points at 13,118; according to IG.

Reference: Reuters, CNBC