· Gold was steady on Monday as investors await cues from the U.S. Federal Reserve on interest rates later this week, while trying to size up the chances of a new round of U.S. tariffs on Chinese goods.

Spot gold was flat at $1,460 per ounce by 0500 GMT. U.S. gold futures was flat at $1,464.50.

· The U.S. Fed will meet on Dec.10-12 for an interest rate decision and investors were likely to focus on the outlook for next year and beyond.

A strong U.S. jobs data last week has renewed bets that the Federal Reserve would stand pat on interest rates. Lower interest rates reduce the opportunity cost of holding non-yielding bullion.

· Meanwhile, the Dec. 15 deadline is still in place for a new round of U.S. tariffs on about $156 billion worth of Chinese imports, White House economic adviser Larry Kudlow said on Friday.

· "Markets are waiting to size up what happens, they're waiting both for the U.S. Federal Reserve meeting and some sort of last minute deal (between U.S.-China)," said Ilya Spivak, a senior currency strategist at DailyFx.

"We've seen that from this administration in White House, this kind of brinkmanship where they may decide to cancel tariffs at the last second by a tweet late night on Dec. 14."

Gold has gained more than 13% so far this year after the Fed cut rates three times this year on the backdrop of the U.S.-China trade war and its impact on economy.

"If the tariffs go into effect into the weekend ... gold then looks decidedly cheap and we might see an upside breakout," Spivak said.

· However, limiting gold's gains, data showed growth in China's imports. This follows solid U.S. job growth in November, on which gold prices shed 1% on Friday, registering their biggest daily percentage fall in a month.

· "Prices are likely to remain in pressure with better-than-expected data we saw late last week," ANZ analyst Daniel Hynes said.

Speculators upped their bullish positions in COMEX gold in the week to Dec. 3, data showed.

· However, holdings of the world's largest gold-backed exchange-traded fund SPDR Gold Trust , fell 0.26% to their lowest since Sept. 19 on Friday.

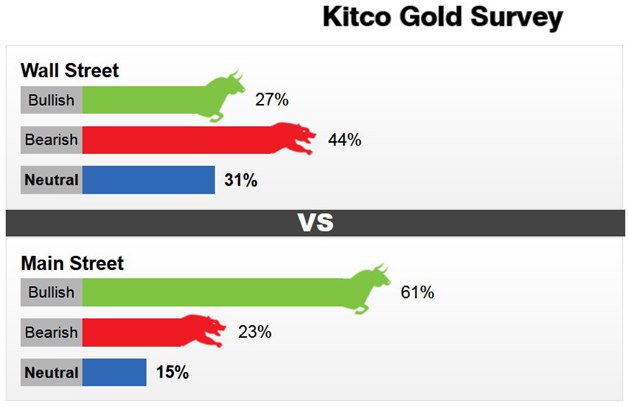

· Main Street turns bullish on gold while Wall Street remains cautious on prices

There are mixed messages in the gold market as some Wall Street analysts expect strong labor-market data to weigh on gold prices next week; meanwhile, bullish sentiment has picked up among Main Street investors, according to the latest Kitco News Weekly Gold Survey.

“Today's surprisingly strong jobs report is an albatross around the neck of our favorite metal -- at least for the short-term,” said Richard Baker, editor of the Eureka Miner Report. “I think it likely that the stock rally will continue into next week and the yellow metal will retest the $1,450 level.”

Fawad Razaqzada, technical analyst, at City Index, said that although gold prices could push lower in the near term, he is bullish on gold. However, he added that because the metal remains range-bound, prices could be see a near-term bounce off the lower end of their channel.

Afshin Nabavi, head of trading with MKS (Switzerland) SA, said that he is not expecting gold to break out of its current range. He added that even if momentum in the U.S. labor market does weigh on gold in the near term, there is enough uncertainty to support gold.

“Investors will continue to buy and sell the trade-war headlines,” he said. “But because of all the uncertainty, I still like playing gold from the long side.”

Daniel Pavilonis, senior commodities broker with RJO Futures, said that stronger equity markets will weigh on gold in the near term. He added that he is watching the yellow metal’s 200-day moving average near $1,420.

Mark Leibovit, publisher of VR Metals/Resource Letter, said that he remains bullish on gold but he is looking to re-enter the market at lower prices. He added that he is watching to see if prices will fall to $1,400 an ounce.

· Palladium shed 0.1% to $1,876.78 per ounce, having hit a record peak at $1,880.65 in the previous session.

· Silver rose 0.1% to $16.57 per ounce, after touching its lowest since early August in the last session, while platinum eased 0.4% to $892.30.

Reference: Reuters,Kitco