· U.S. stock index futures were mixed Wednesday morning, as investors wait to hear from the Federal Reserve.

At around 1:30 a.m. ET, Dow futures dropped 15 points, but indicated a positive open of more than 14 points. Futures on the S&P and Nasdaq were both pointing to a slightly higher open.

Market players seem cautious amid uncertainty on the U.S.-China trade front. There is no clear indication that both countries will reach an agreement over trade that could stop or reduce the current level of tariffs. The U.S. is due to impose fresh duties on Chinese goods by Sunday.

· Asian stocks extended earlier gains on Wednesday, although advances were patchy ahead of key central bank meetings while the pound wobbled as opinion polls pointed to a tight UK election later this week.

Investors were also cautious ahead of Washington’s deadline for new tariffs on Chinese goods this Sunday, although stronger-than-expected Chinese loans data provided some support for sentiment.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.5% higher. Hong Kong’s Hang Seng and Australia’s S&P/ASX 200 led gains with 0.7% rises. Shanghai blue chips rose 0.2%.

Japan’s Nikkei was unchanged. Futures pointed to flat open in Europe and on Wall Street.

· Tokyo stocks fell on Wednesday as investors locked in profits ahead of major events such as the UK election and a US Fed meeting with eyes kept on the US-China trade talks.

The benchmark Nikkei 225 index slipped 0.08 per cent or 18.33 points to 23,391.86, while the broader Topix index gave up 0.34 per cent or 5.82 points to 1,714.95.

· Shares in China inched higher on Wednesday on hopes that fresh U.S. tariffs on Chinese goods may be delayed, but gains were limited amid the lack of formal confirmation from Beijing and Washington.

The Shanghai Composite index closed up 0.2% at 2,924.42, after hitting its highest level since Nov. 20 earlier in the session. The blue-chip CSI300 index climbed 0.1%.

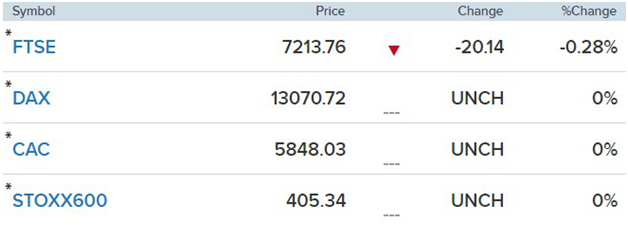

· European stocks made a cautious start Wednesday as investors await the U.S. Federal Reserve’s interest rate decision and monitor developments ahead of the weekend’s U.S.-China trade tariff deadline.

The Fed’s final interest rate decision of the year is due later in the day stateside, with the central bank widely expected to hold rates steady.

Meanwhile traders will be keeping a keen eye on discussions between the U.S. and China ahead of Sunday’s planned implementation of an additional 15% tariffs on around $160 billion in Chinese exports to the U.S.

Reference: Reuters, CNBC