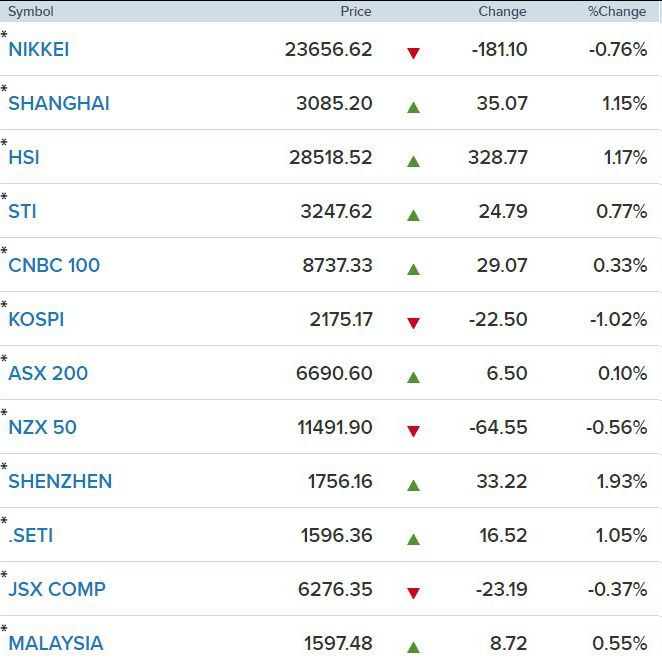

· Asian shares kicked off 2020 on a strong note on Thursday, spurred by Chinese markets after Beijing eased monetary policy to support the slowing economy.

Investors also cheered news that the United States and China will sign a trade pact soon after months of volatile negotiations between the world’s two largest economies.

MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.35% in morning trade after rising 5.6% in December.

U.S. President Donald Trump said on Tuesday that Phase 1 of trade deal with China would be signed on Jan. 15 at the White House, though uncertainty surrounds details about the agreement.

Rising hopes for a resolution to the U.S.-China trade war helped propel global equities to record highs late last year and depress the value of the U.S. dollar.

· Chinese shares rallied on the first trading day of the new decade on Thursday after U.S. President Donald Trump said he will seal a deal with Beijing mid-month and as the Chinese central bank ramped up policy support.

The Shanghai Composite index was up 1.2% at 3,085.20 points - its highest level since last April. The blue-chip CSI300 index climbed 1.4% to its highest level since February 2018.

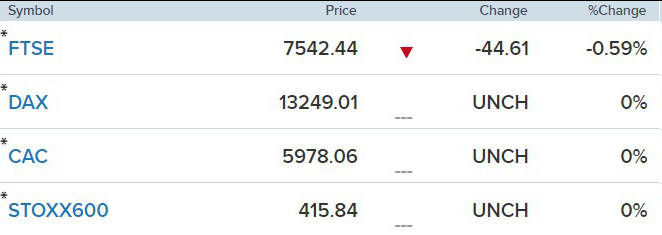

· European stocks opened higher Thursday morning after U.S. President Donald Trump said that a phase one trade deal with China will be signed on January 15, though details of the deal remain hazy.

The pan-European Stoxx 600 climbed 0.4% at the opening bell, basic resources rising 0.9% to lead gains as almost all sectors and major bourses entered positive territory.

Reference: Reuters, CNBC