· Asian stock markets recovered ground on Wednesday as China’s response to a virus outbreak tempered some fears of a global pandemic, although Shanghai shares initially slipped amid worries about a hit to domestic demand and tourism.

The MSCI index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.71%, recouping almost half Tuesday’s drop.

“The call here is not that the virus is done or nipped in the bud by any means,” said Kay Van-Petersen, global macro strategist at Saxo Capital Markets.

“But there have been no big further reported outbreaks, and the response from the Chinese authorities has been very, very positive ... China is 1.4 billion people. This is not the first time they’re tackling a bug that’s gotten out of hand.”

· Japanese shares staged a modest rebound on Wednesday, as earlier investor panic about the coronavirus in China abated, although hygeine-related firms remained in demand and pressure on the tourism sector persisted.

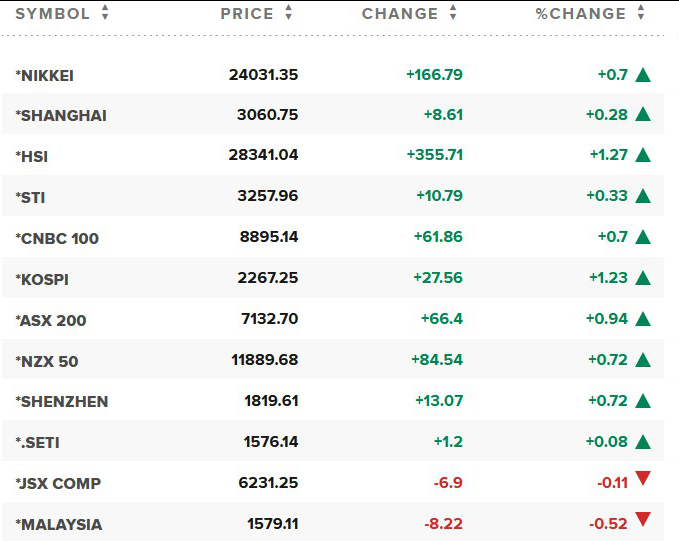

· Mainland Chinese stocks made a turnaround to close higher after dropping more than 1% in the morning. The Shenzhen component added 1.08% to 11,072.06 and the Shenzhen composite rose 0.724% to 1,819.61. The Shanghai composite advanced 0.28% to around 3,060.75.

Hong Kong’s Hang Seng index was 1.32% higher, as of its final hour of trading, after leading losses among major Asian markets on Tuesday.

Elsewhere in Asia, the Nikkei 225 rose 0.7% to close at 24,031.35 while the Topix index added 0.53% to end its trading day at 1,744.13.

The Kospi in South Korea also gained 1.23% to close at 2,267.25. The Bank of Korea said Wednesday the country’s economy grew 1.2% on a seasonally adjusted basis in the fourth quarter as compared with three months earlier. That was the fastest expansion since the third quarter of 2017, beating an estimated 0.8% growth from a Reuters poll.

Meanwhile, stocks in Australia rose as the S&P/ASX 200 closed 0.94% higher at 7,132.70.

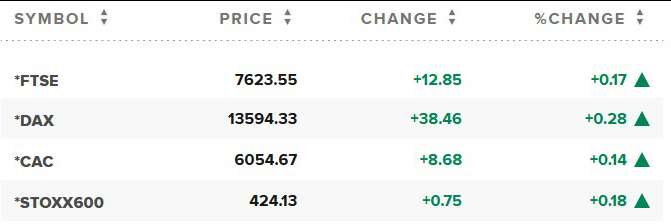

· European markets opened cautiously higher on Wednesday after China unveiled measures to rein in the spread of a new strain of coronavirus that has killed nine people so far.

The pan-European Stoxx 600 edged up 0.2% in early trade, with media stocks adding 0.5% to lead gains while autos dropped 0.7%.

Stocks worldwide began a tentative rebound Wednesday as the Chinese government’s plans to contain the virus seemed to ease equity investors’ concerns over a possible academic, though markets will remain attuned to news out of China.

· Thai monetary policy should be accommodative for some time: central bank

Thailand’s central bank said monetary policy should remain accommodative for some time to support economic growth and help inflation return to target.

The Monetary Policy Committee (MPC) expects headline inflation - projected at 0.8% this year - to get back to the 1%-3% target range in the second half of 2021, the central bank said in an open letter to the finance minister dated Jan. 9.

The breach of the target would be driven by supply-side pressures that would remain low, since a gradual global economic recovery continues to weigh on global energy prices, it said.

The MPC stands ready to use various tools, ranging from the policy interest rate to microprudential and macroprudential measures, to achieve the monetary policy objectives most effectively, it added.

The central bank left the benchmark interest rate THCBIR=ECI unchanged at a record low of 1.25% in December, after cutting it twice earlier in the year to support flagging growth and curb a strengthening baht THB=TH.

It will next review monetary policy on Feb. 5

The MPC has closely monitored the impact of exchange rates on the export sector given heightened external risks, the central bank said.

Reference: Reuters, CNBC