· Asian shares stumbled on Monday, oil skidded and commodities on Chinese exchanges plunged on their first trading day after a long break on fears the coronavirus epidemic will hit demand in the world’s second-largest economy

Aiming to head off any panic, the Chinese government took a range of steps to shore up an economy hit by travel curbs and business shut-downs because of the epidemic, including cutting its key interest rate.

Despite the measures, MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.4%, on track for its eighth straight day of losses.

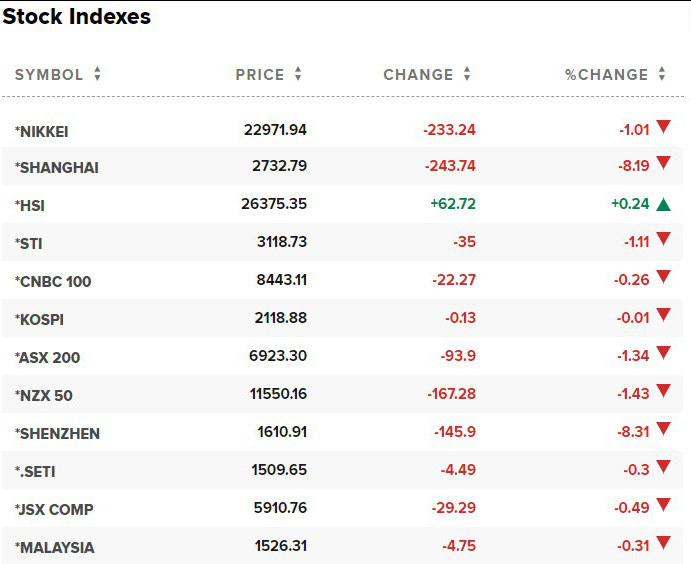

Chinese shares slumped at the open with the blue-chip index down about 7%.

· Japanese shares closed lower on Monday, tracking a sharp sell-off in Chinese equities, on rising worries over the economic impact from the coronavirus outbreak in China.

The Nikkei index ended 1.01% lower at 22,971.94, with consumer discretionary and information technology sectors leading declines.

Chinese markets, which were closed since the end of trade on Jan. 23 for Lunar New Year holidays, reopened on Monday with a steep fall of more than 9%.

The number of deaths from the virus jumped to 361 as of Sunday, the country’s health authority said on Monday.

Economists have already warned the outbreak will weigh on consumer spending, tourism, and factory activity in the world’s second-largest economy, which could weigh on Japan too, as China is one of the country’s top export markets.

· Chinese stock and commodity markets fell heavily on Monday as the death toll from a coronavirus epidemic in China rose to 361 and investors retreated into safe-haven assets in the first trading session after an extended Lunar New Year break.

Markets plunged at the open in their first session since Jan. 23, when the outbreak of the newly identified virus had claimed only 17 lives in Wuhan city, the epicenter of the outbreak, in Hubei province.

The number of deaths in China rose to 361 as of Sunday, up 57 from the previous day, the National Health Commission said. The number of new confirmed infections in China rose by 2,829, bringing the total to 17,205.

The Shanghai Composite index shed 8% to hit one-year low on Monday, wiping almost $370 billion off the market value, according to Reuters calculations.

The yuan began trade onshore at its weakest level this year. Iron, oil and copper traded in Shanghai all dropped by their daily limits, catching up with global price falls as the spread of the virus has weighed on the world’s growth outlook.

Investors were bracing for volatility when onshore trade in Chinese stocks, bonds, yuan and commodities resumed, following a steep global selldown on fears about the impact of the virus on the world’s second-biggest economy.

Looking to head off panic, China’s central bank injected 1.2 trillion yuan ($173.8 billion) of liquidity into the markets via reverse repo operations on Monday.

.png)

· European markets were muted on Monday as investors appeared to brush off concerns over the U.K.’s departure from the EU, which took place last Friday, and the latest coronavirus developments.

The pan-European Stoxx 600 hovered around the flatline in early trade, with basic resources shedding 1.1% to lead losses while travel and leisure stocks climbed 0.5%.

Monday is the first trading day since Brexit took place. The U.K. exited the EU at 11 p.m. on Friday and has now started an 11-month transition period in which it hopes to strike a trade deal with the bloc.

Reference: Reuters, CNBC