· Gold inches up on virus concerns; set for worst week since early Nov

Gold prices edged higher on Friday as fears over a rapidly spreading coronavirus outbreak and its economic impact fueled safe-haven buying.

· However, China’s move to cut tariffs on some U.S. imports that sent global stock markets higher in the previous session weighed on bullion prices.

Spot gold was up 0.1% to $1,568.76 per ounce by 0052 GMT. The metal has fallen 1.3% so far this week, heading for its worst week since Nov. 8. U.S. gold futures were flat at $1,570.70.

The death toll from the coronavirus outbreak in mainland China reached 636 by the end of Thursday, up 73 from the previous day, the National Health Commission said.

· Asian shares eased as investors remained jittery about the widespread virus outbreak.

· Beijing said it would lower extra levies imposed last year on 1,717 U.S. products, weeks after the signing of a Phase 1 trade deal that brought a truce to a bruising tariff dispute between the world’s two largest economies.

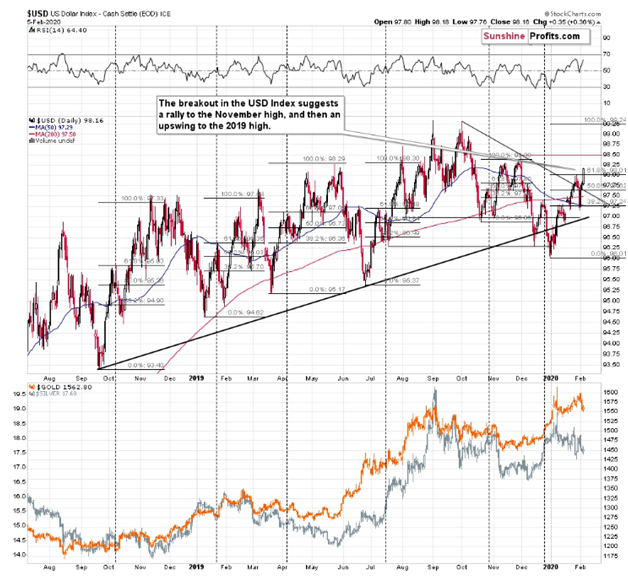

· The dollar was on track for its best weekly gain since early November, amid upbeat economic indicators ahead of the U.S. non-farm payrolls data.

· U.S. weekly jobless claims hit a nine-month low as the number of Americans filing for unemployment benefits dropped to 202,000 last week, while productivity rebounded in the fourth quarter.

· U.S. Federal Reserve Vice Chair Randal Quarles said policymakers should consider changes that would make it easier for banks to treat Treasury holdings as similar to reserves held with the central bank when meeting liquidity requirements.

Two illegal Zimbabwean miners died and another was injured after the gold mine they were working in collapsed, the disaster management agency said on Thursday.

· Palladium advanced 0.4% to $2,355.36 an ounce, silver rose 0.1% to $17.83, and platinum edged higher by 0.1% to $962.87.

· Gold Price News and Forecast: The coronavirus should not be ignored by XAU/USD investors

· Gold better bid, savvy investors taking heed of elephant in the room

Despite the flurry to the equities on the back of progress with the phase-one trade agreement between the US and China, gold prices are also on the up. At the time of writing, gold trades at $1,565 having travelled from a low of $1,552.67 to a high of $1,568.21.

- Gold Resists Soaring USD – The Show’s Not Over Yet

The precious metals market didn’t do much yesterday, but – what may seem surprising - that’s quite bullish. It’s bullish, because the USD Index rallied to new yearly highs and this “should have” caused the PMs and miners to decline. It didn’t, which suggests that the decline is not yet ripe for continuation.

Reference: Reuters, DailyFX