· Gold prices held steady above the key $1,600 mark on Wednesday as an uptick in equities due to a drop in new virus cases was kept in check by fears about the economic fallout of the epidemic.

Autocatalyst metal palladium, meanwhile, scaled yet another record peak on a sustained supply shortfall.

Spot gold was little changed at $1,601.77 per ounce by 0244 GMT. In the previous session, bullion prices surged 1.3% to their highest since Jan. 8 at $1,605.10.

U.S. gold futures were up 0.1% to $1,604.80.

Asian shares and U.S. stock futures edged cautiously higher as investors tried to shake off worries about the epidemic.

· "The big wave of risk-off has sort of dissipated right now, but still the economic fallout is buttressing the demand for gold," Stephen Innes, chief market strategist at AxiCorp.

The increase in the number of new virus cases slowed in China's Hubei province even as the death toll rose by 132 as of Tuesday.

The U.S. dollar, also considered a safe-haven during times of economical and political uncertainties, stayed above the more than four-month high against key rivals.

· "The stronger dollar is not really curbing the inflows to gold ... from an inflation perspective, a stronger U.S. dollar is working against the U.S. Federal Reserve's inflation target and is pointing towards lower interest rates," Innes said.

Investors will closely read the minutes of the Federal Reserve's Jan. 28-29 policy meeting, which is due at 1900 GMT.

Lower interest rates reduce the opportunity cost of holding non-yielding bullion and also weigh on the U.S. currency.

Indicative of investor sentiment, holdings of the world's largest gold-backed exchange-traded fund, SPDR Gold Trust, rose 0.6% to 929.84 tonnes on Tuesday, their highest since Nov. 11, 2016.

· "The short-term dynamics are very difficult to tell simply because the market is in a position where it is considerably over-bought and if we get (any) positive news it could possibly trigger a downside move (in gold)," Innes said.

|

|

|

· Gold Price Analysis: Eyes re-test of the 2020 high on pennant breakout

Gold jumped 1.32% on Tuesday, confirming an upside break of the six-week-long narrowing price range or the pennant pattern on the daily chart.

The breakout indicates the rally from November lows near $1,445 has resumed. Tuesday's close also invalidated the bearish lower high of $1,593.90 established on Feb. 3.

Additionally, the 5- and 10-day averages are trending north, indicating a strong upward momentum and the relative strength index has breached the descending trendline in favor of the bulls.

All in all, the metal looks set to test the 2020 high of $1,611 reached on Jan. 8. The bullish case would be invalidated if prices find re-enter the pennant pattern with a drop below $1,580.

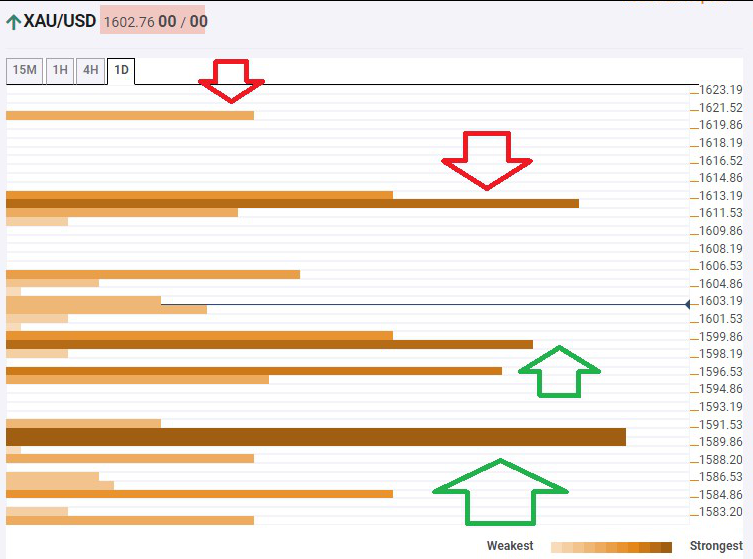

· Gold Price Analysis: Eyeing $1,612, $1,620 as next bullish levels amid coronavirus fears – Confluence Detector

Coronavirus fears continue underpinning gold prices. While China has announced measures to help the economy, fears of growing economic damage, XAU/USD is holding onto gains above $1,600. What are the next levels to watch?

The Technical Confluences Indicator is showing that significant resistance awaits at $1,612, which is the convergence of the multi-year high, the Pivot Point one-day Resistance 1, the PP one-week R3, and the Bollinger Band 1h-Upper.

Further above, the upside target is $1,620, which is where the Pivot Point one-day Resistance 2 hits the price.

Looking down, substantial support is at $1,599, which is the confluence of the Fibonacci 23.6% one-day, the previous 4h-low, the Simple Moving Average 5-4h, the PP one-week R2, and more.

Further down, a considerable cushion awaits gold prices at $1,594, which is a juncture including the Fibonacci 61.8% one-day, the PP one-week R1, the SMA 5-1h, and the Fibonacci 23.6% one-month.

· Palladium jumped 1.6% to $2,677.09 an ounce, having scaled a record high of $2,683.50 earlier in the session.

Plagued by sustained supply deficit, palladium, used mainly in catalytic converters in vehicles, rose about 54% in 2019.

Silver was up 0.4% to $18.24, having earlier touched a three-week peak at $18.26. Platinum also hit its highest in three weeks earlier in the session, at $1,001.67, and was up 0.8% to $1,000.02 as of 0244 GMT.

Reference: Reuters ,CNBC, FX Street