· Gold prices rose on Thursday as the rapid spread of coronavirus outside China fuelled demand for safe-haven assets and bolstered bets for interest rate cuts by major central banks, while palladium scaled an all-time high on supply deficit worries.

Spot gold rose 0.8% to $1,651.95 per ounce by 0615 GMT. Prices jumped more than 1% in intraday trade on Wednesday before closing 0.3% higher.

U.S. gold futures were up 0.7% at $1,654.00.

· "Safe-haven demand is strong at the moment on the global economic impact of the coronavirus. There are growing expectations that central banks will certainly need to take action if it continues to spread, particularly outside China," ANZ analyst Daniel Hynes said.

The number of new coronavirus infections inside China – the source of the outbreak - was for the first time overtaken by fresh cases elsewhere on Wednesday, with Italy and Iran emerging as epicentres of the rapidly spreading illness.

· U.S. health authorities, managing 59 cases so far, warned of the potential for a pandemic, although President Donald Trump said the country was in "great shape" to handle a looming health crisis.

· Oil and Asian share markets slipped on Thursday, as investors sought safety in gold and bonds. Benchmark U.S. 10-year Treasury yields also hit a record low earlier in the session.

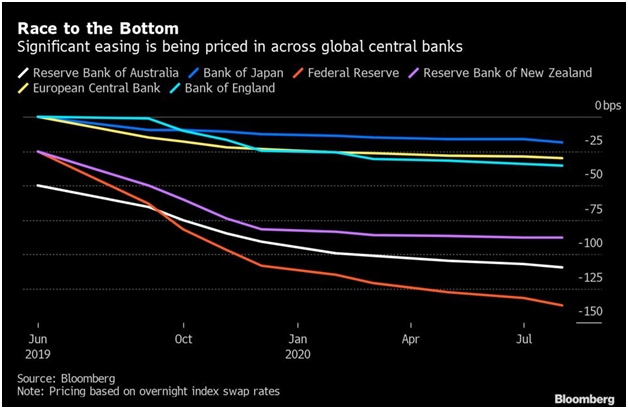

· Investors, meanwhile, have increased bets for a rate cut by the U.S. Federal Reserve to ease the impact on the economy, according to an analysis of Fed funds futures compiled by the

CME Group. Money markets have also priced in cuts by the European Central Bank and the Bank of England.

· "Markets are already pricing in some decent cuts to rates across the globe so that's the clear driver of (gold) prices and demand," ANZ's Hynes said.

Lower interest rates reduce the opportunity cost of holding non-yielding bullion.

· Among other precious metals, palladium dipped 0.1% to $2,787.64 per ounce, after hitting a record high of 2,847.50 earlier in the session.

· A correction in palladium prices is likely but the metal is rallying on deficit concerns and overall positive sentiment in precious metals, said Jigar Trivedi, a commodities analyst at Anand Rathi Shares and Stock Brokers in Mumbai.

· Platinum rose 1.2% to $921.62, having earlier touched its lowest level since December.

· Silver gained 1.3% to $18.12 an ounce, after having touched a one-week low in the previous session.

· Gold Price Analysis: On its way to short-term horizontal resistance

Gold prices take the bids near $1,650, +0.84%, by the press time of early Thursday. With that, the bullion carries its U-turn marked on Wednesday.

The yellow metal recently reversed from $1,625 and is heading towards multiple resistances around $1,659.

Should prices manage to cross $1,659, as widely expected considering normal conditions of RSI and broadly bullish fundamentals, $1,673 may offer an intermediate halt before fueling prices to the latest high surrounding $1,690.

During the safe-haven’s run-up past-$1,690, $1,700 could please the bulls.

Reference: Reuters , FX Street, Bloomberg