· Gold prices retreated on Friday as investors booked profits from a 1% jump in the last session, but the metal had some support as mounting concerns over the rapid spread of coronavirus outbreak lifted expectations of rate cuts by major central banks.

Palladium, meanwhile, fell as much as 5% on profit-taking after the autocatalyst metal soared to an all-time high on Thursday.

Spot gold was down 0.4% at $1,635.39 per ounce by 0422 GMT. The metal has added about 3% so far this month, its third straight monthly gain.

U.S. gold futures inched down 0.3% to $1,637.00 per ounce.

· "This virus is getting a lot more serious … People are worried there might be a need for some more stimulus measures, so that means lower (interest) rates," said John Sharma, economist at National Australia Bank, adding that high prices led to some profit-taking.

Governments from Iran to Australia shut schools, cancelled big events, stocked up on medical supplies and prepared emergency responses as new infections reported around the world surpassed those in mainland China.

A Reuters tally showed about 10 countries reported their first cases in the past 24 hours, including Nigeria, and the World Health Organization said all countries needed to prepare to combat the virus.

World share markets were headed for the worst week since the depths of the 2008 financial crisis as investors braced for the virus impact on economic growth.

· Meanwhile, bets rose that the U.S. Federal Reserve would cut interest rates as soon as next month to cushion the economy from the virus impact.

Four European Central Bank policymakers, however, played down the prospect of immediate action.

Lower interest rates reduce the opportunity cost of holding non-yielding bullion.

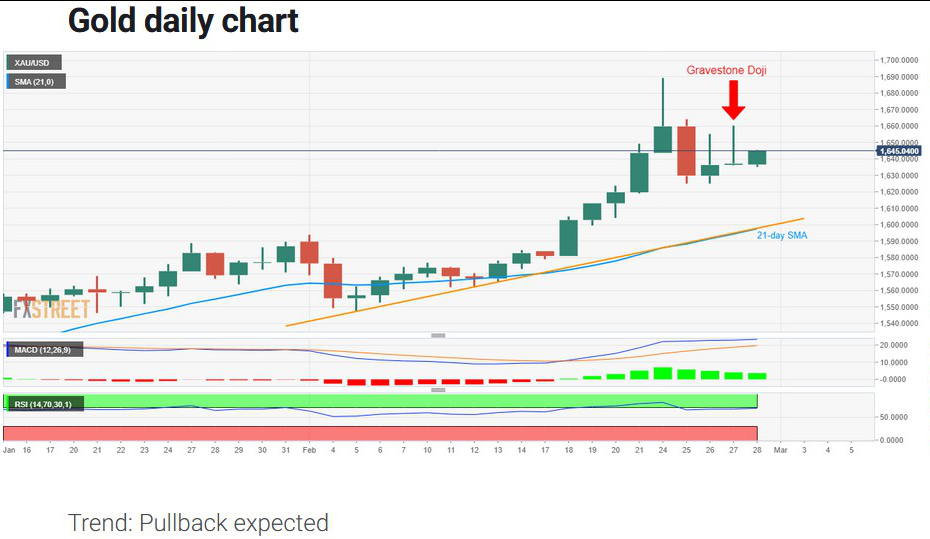

· Gold Price Analysis: Gravestone Doji on D1 questions the bulls

Gold prices take the bids near $1,645 during the initial hours of Asian trading on Friday. In doing so, the pair challenges the previous day’s bearish candlestick formation that raises hopes of a pullback until defied. Also challenging the bulls are overbought conditions of RSI.

That said, the buyers should look for entry only beyond $1,661 as it will defy the bearish candlestick on the daily (D1) chart.

Following that, the bullion can take aim at the recent highs near $1,690 and $1,697 numbers to the north before targeting the $1,700 round-figures.

On the downside, lows marked on Tuesday and Wednesday surrounding $1,625 can entertain short-term sellers.

Though, buyers are less likely to accept the defeat unless the quote breaks below 21-day SMA and short-term rising support line, around $1,598/97.

· Among other precious metals, palladium slipped 3.4% to $2,749.63 per ounce, but was on track to register its best month since November 2016.

Palladium jumped to a record $2,875.50 in the previous session on a sustained supply shortfall, with the world's largest producer of the metal, Nornickel, projecting a global deficit of 0.9 million ounces in 2020.

"Despite palladium having undergone some price corrections, it was much stronger than some expected, considering it's an industrial, rather than monetary metal," said Samson Li, a Hong Kong-based precious metals analyst at Refinitiv GFMS.

"When sentiment is ruled by fear, investors always rush to cash and liquidity, and also sell profitable investments due to margin calls or to cover other investment losses."

Platinum shed 2.6% to $875.10, en route to its worst week since November 2015.

Silver fell 1.1% to $17.50 an ounce, on track to post its worst month in three, down more than 3.0%.

Reference: Reuters , FX Street