· Gold prices jumped in early trade on Monday after another emergency rate cut by the U.S. Federal

Reserve, before paring gains as some investors sold the metal for cash amid a sell-off in equities.

Spot gold was up 0.2% at $1,532.12 per ounce by 0726 GMT, having risen as much as 2.8% earlier. The metal fell 3% on Friday. U.S. gold futures rose 1% to $1,531.60 per ounce.

· Prices rose initially due to the surprise Fed rate cut, said CMC Markets analyst Margaret Yang Yan, adding that: "The market is very indecisive and there are divergent opinions. Investors are now dumping everything. They just want cash."

The Fed slashed rates back to near zero, restarted bond buying to help put a floor under a rapidly disintegrating global economy amid the escalating coronavirus pandemic.

· The Fed's rate cuts and restarting of quantitative easing are positives for gold, but "we're in an unconventional time and theory might not apply in a time of high volatility and divergence", Yan said.

The dollar fell from a more than two-week high and stock markets plunged after the Fed cut rates for the second time this year to soften the economic blow from the economic shock.

The benchmark U.S. 10-year Treasury yields fell, resuming its march towards an all-time low touched last week, while the safe-haven yen rose from a two-week low against the dollar.

· A widespread pandemic causing a global shutdown, emergency rate cuts and falling U.S. dollar should be "nirvana for gold", Jeffrey Halley, a senior market analyst at OANDA, said in a note.

"Unfortunately, these are not normal times and the usual rules don't seem to apply anymore," he said.

Generally, lower interest rates reduce the opportunity cost of holding non-yielding bullion, and weigh on the dollar, making greenback-denominated gold cheaper for investors holding other currencies.

· The Fed's latest cut could support gold in the medium to longer term as it suggests the economy is in a downtrend and the negative impact of coronavirus is likely to continue, said Hareesh V, head of commodity research at Geojit Financial Services.

Following the Fed, New Zealand slashed rates to a record low, while European Union finance ministers plan to agree on a coordinated economic response.

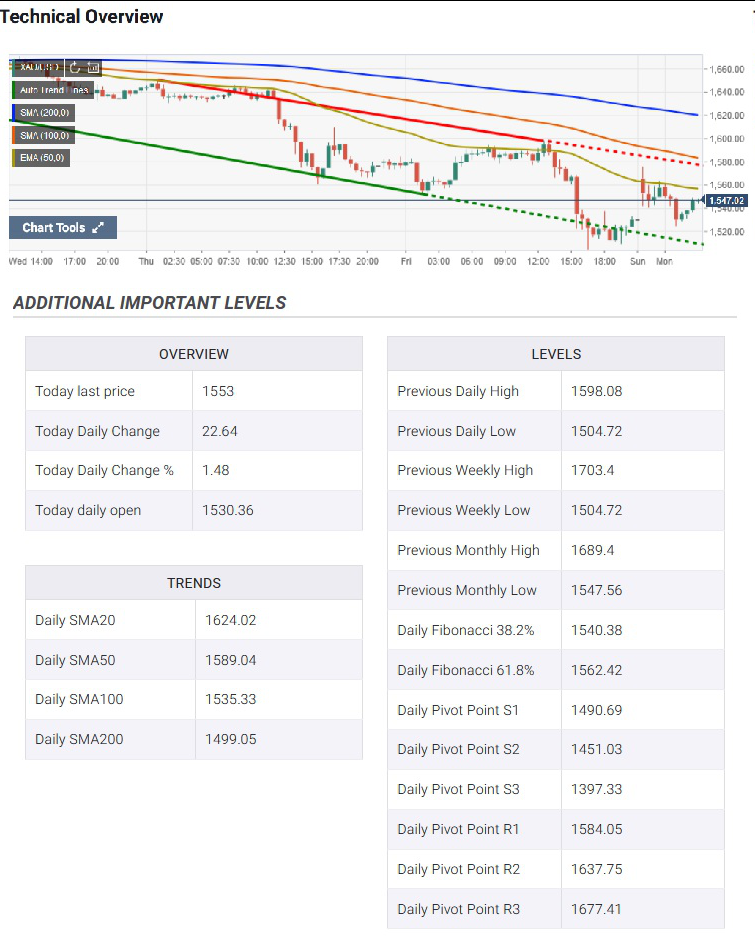

· Gold Price Analysis: Remains under pressure below $1550 after central banks surprise

Gold declines to $1,549 after the Fed Chair’s speech during the early Asian session on Monday. The yellow metal initially benefited from the surprise rate cuts from the RBNZ and the Fed.

The Fed Chair speaks after the US central bank surprised global markets with another rate cut in the month, to 0.25%, together with $700 billion worth of Quantitative Easing (QE).

Earlier, the RBNZ finally joined the league of global central bankers to announce high sized rate cuts. The New Zealand central bank slashed benchmark interest rate by 0.75 basis points (bps) to 0.25%.

Technical Analysis

FXStreet analysis Ross J Burland cites the yellow metal’s U-turn from 200-DMA as a trigger to witness a pullback towards a 38.2% Fibonacci retracement level.

“The return of risk appetite was adverse to gold prices, suffering a flight to cash to pay-up for margin calls mid-week. On Friday, the nail in the coffin came from US President Donald Trump declaring a national emergency and allowing more than $40 billion of FEMA funds to deal with the COVID crisis. The move sent stocks much higher and US treasuries lower, pressuring yields and the US higher, subsequently taking down gold prices to a weekly support line. Gold reverted to the levels seen during the last bout of liquidity selling in late February, around $1,560/oz and then dropped to a low of $1,504.34/oz (just above the 200-DMA, $1,497) as investors sold winners to generate liquidity and cover losses.”

· The opening range for 2020 instilled a constructive outlook for the price of gold as the precious metal cleared the 2019 high ($1557), with the Relative Strength Index (RSI) pushing into overbought territory during the same period.

A similar scenario materialized in February, with the price of gold marking the monthly low ($1548) during the first full week, while the RSI broke out of the bearish formation from earlier this year to push back into overbought territory.

However, the price of gold has failed to maintain the monthly opening range for March after trading to a fresh yearly high ($1704), with the Relative Strength Index (RSI) signaling a potential change in gold price behavior as the oscillator deviates with price and snaps the upward trend carried over from last year.

In turn, the price of gold may continue to consolidate over the coming days, but a break/close below the $1558 (38.2% expansion) to $1567 (161.8% expansion) region may open up the Fibonacci overlap around $1509 (61.8% retracement) to $1515 (23.6% expansion).

· Gold drops under $1,540 amid global central bankers’ play, BOJ in spotlight

With the global central bankers running the show, led by Fed and RBNZ, Gold prices decline to $1,533 by the press time of early Monday.

While the Fed’s second rate cut in the month, the first one by the RBNZ so far, triggered the initial pullback in the yellow metal, BOJ’s announcement of the emergency meeting seems to trigger the latest recovery. Additionally, RBA also crossed wires recently while saying to take further steps on Thursday.

Following the BOJ, European Finance Ministers are up for a meeting whereas the Group of Seven (G7) will also hold a teleconference to address the pandemic.

Coronavirus (COVID-19) has been weighing on the market’s trade sentiment off-late, pushing investors away from trading/investment. The latest updates from Italy and France have been worrisome while those from China keep stepping back.

Given the central bankers’ play in the spotlight, any more announcements/surprises will be taken seriously for near-term trade direction. It should, however, be noted that coronavirus updates will also keep their importance in the meantime.

Technical Analysis

Unless providing a daily close below 200-day SMA, currently around $1,499.50, gold prices are less likely to lose hopes to revisit $1,600.

· In a volatile trade, palladium fell 1% to $1,788.76, having fallen more than 5% earlier. Platinum slipped 0.8% to $755.50 per ounce, while silver fell 1.5% to $14.45.

Reference: Reuters, CNBC, FXStreet