· Dollar and yen hold advantage as risk aversion grows

The dollar and the yen edged higher on Thursday as growing concerns about a rise in coronavirus cases underpinned safe-haven demand for both currencies.

The Australian dollar fell after data showed the economy shed twice as many jobs as expected in May, highlighting the damage caused by lockdown restrictions put in place by the government to contain the outbreak.

The British pound traded in a narrow range before a Bank of England meeting where policymakers are expected to expand quantitative easing in the face of a sputtering economy and rocky trade negotiations with the European Union.

A surge in new coronavirus infections in several U.S. states and the imposition of travel curbs in Beijing to stop a new outbreak there have served as a reminder about the risks of re-opening economic activity before a vaccine has been developed.

The dollar traded at $1.1256 per euro EUR=EBS on Thursday following a 0.2% gain in the previous session.

The greenback bought 0.9493 Swiss franc CHF=EBS, holding onto a 0.3% gain on Wednesday.

The yen JPY=D3 edged up to 106.86 against the dollar.

Sterling GBP=D3 inched down to $1.2557. Against the euro, the pound was little changed at 89.65 pence EURGBP=.

The onshore yuan CNY=CFXS rose slightly to 7.0735 per dollar after China's top policymakers vowed to keep cash abundant in financial markets and further support growth.

· Fed's Bostic says pandemic exacerbated structural inequalities

The coronavirus pandemic is hitting minority communities harder than others and recent incidents of racial discrimination around the country have shed light on the moral and economic costs of racism, Atlanta Federal Reserve Bank President Raphael Bostic said Wednesday.

“The pandemic has hit lower income and minority communities much harder than it has others and really exacerbated a lot of the structural inequalities that we had seen in this country,” Bostic said Wednesday during a virtual event with the Atlanta Consular Corps.

Bostic, the Fed’s only African American policymaker, last week issued an impassioned call for an end to racism and laid out ways the U.S. central bank can help do so.

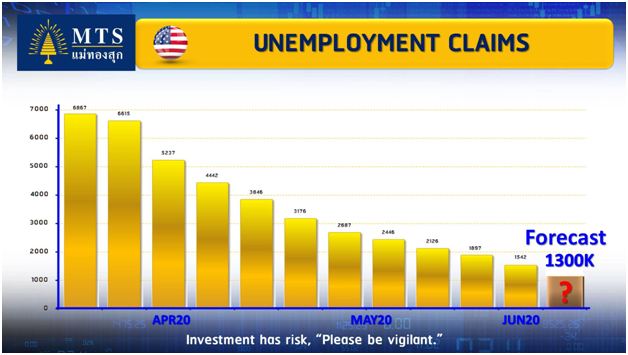

· U.S. weekly jobless claims remain high, second wave of layoffs blamed

A second wave of layoffs amid weak demand and fractured supply chains is likely keeping new U.S. applications for unemployment benefits elevated, supporting views that the economy faces a long and difficult recovery from the COVID-19 recession.

The Labor Department’s weekly jobless claims report on Thursday, the most timely data on the economy’s health, is expected to sketch a picture of continued labor market distress even though employers hired a record 2.5 million workers in May as businesses reopened after shuttering in mid-March to slow the spread of COVID-19.

Millions are still collecting unemployment checks. Federal Reserve Chair Jerome Powell told lawmakers this week that “significant uncertainty remains about the timing and strength of the recovery.” The economy fell into recession in February.

· China central bank to keep liquidity ample, weigh policy exit strategy

China will keep liquidity ample in the second half of the year, but it should consider in advance the timely withdrawal of policy measures aimed at countering the effects of the COVID-19 pandemic, the country’s central bank governor said on Thursday.

China’s economic fundamentals remain sound and its financial markets are stable overall, Yi Gang told a financial forum in Shanghai.

“The financial support during the epidemic response period is (being) phased, we should pay attention to the hangover of the policy,” Yi said.

· EU needs swift decision on budget, recovery fund: Merkel

German Chancellor Angela Merkel on Thursday urged the European Union to swiftly seal a multi-year budget deal and recovery fund to help the bloc survive the economic damage caused by the coronavirus pandemic.

Merkel said that an any agreement would not be reached during a summit of EU leaders on Friday via videoconference but rather at a physical meeting later this year.

· Australia jobless rate surges to 19-year high in May, slow recovery seen

Australia’s unemployment rate jumped to the highest in about two decades in May as nearly a quarter of a million people lost their jobs due to the coronavirus pandemic-driven shutdowns.

Employment in May plunged a further 227,700 after a record slump of about 600,000 in April, figures from the Australian Bureau of Statistics (ABS) on Thursday showed.

The unemployment rate shot up to 7.1%, the highest since October 2001, from an upwardly revised 6.4% in April and broadly in line with economists’ expectations in a Reuters poll.

· Oil prices fall as coronavirus case surge heightens demand fears

Oil prices slipped on Thursday on concerns that a spike in new coronavirus cases in China and the United States could dampen a recovery in fuel demand, even as lockdowns ease.

Brent crude LCOc1 futures fell 22 cents, or 0.5%, to $40.49 a barrel at 0623 GMT, having fallen 25 cents in the previous session.

U.S. West Texas Intermediate (WTI) crude CLc1 futures dropped 38 cents, or 1%, to $37.58 a barrel, adding to a loss of 42 cents on Wednesday.

Both benchmarks were down by about 2% earlier in the session.

Reference: CNBC, Reuters