· Stocks meander higher, but virus fears hold optimism in check

Asian stock markets ground higher on Friday, but are set to end a choppy week with only slight gains as surging coronavirus infections cast a shadow over encouraging economic data and checked hopes for a swift global recovery.

MSCI's broadest index of Asia-Pacific shares outside Japan MIAPJ0000PUS rose 0.5%, for a weekly gain of around 0.7%. Japan's Nikkei .N225 rose 1.3% to sit 0.4% higher for the week.

· Japan shares track Wall St higher; banks gain as U.S. regulators relax rules

Japanese shares bounced back on Friday, tracking overnight Wall Street gains, with banks leading the rally in both markets, after U.S. regulators’ decision to ease some rules allayed fears over a spike in fresh COVID-19 cases.

The benchmark Nikkei average rose 1.1% to 22,512.08, rebounding from a 1-1/2-week closing low hit in the previous sessiom. For the week, the index eked out a marginal gain of 0.1%.

The broader Topix rose 1% to 1,577.37, with all but three of the 33 sector sub-indexes on the Tokyo exchange finishing higher.

· Dow futures down nearly 200 points after bank stress test results, Nike reports surprise loss

U.S. stock futures were lower in early morning trade on Friday following the release of the Fed’s latest bank stress-test results and disappointing quarterly numbers out of Nike.

Dow Jones Industrial Average futures were down 173 points, while S&P 500 and Nasdaq-100 futures also traded in negative territory.

The moves came after the Fed’s annual stress test of the major banks showed some banks could get close to minimum capital levels in scenarios related to the coronavirus pandemic. Because of this, banks must suspend share repurchase programs and keep dividend payments at current levels for the third quarter.

Meanwhile, Nike shares slid nearly 4% after the bell on the back of a surprising quarterly loss for the apparel giant.

· European markets climb despite virus fears; Wirecard down 40%

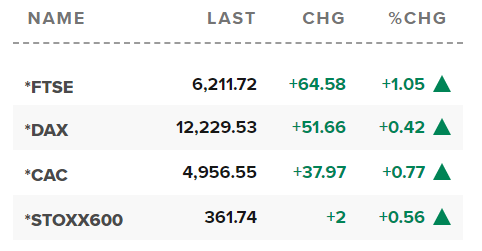

European markets advanced on Friday morning despite surging coronavirus cases in the U.S. and further warnings about a second market meltdown from the International Monetary Fund (IMF).

The pan-European Stoxx 600 climbed 0.6% in early trade, with industrials adding 1.4% to lead gains as all sectors and major bourses entered positive territory.

Reference: CNBC, Reuters