· Nasdaq ends at record high as Wall Street rises with tech shares

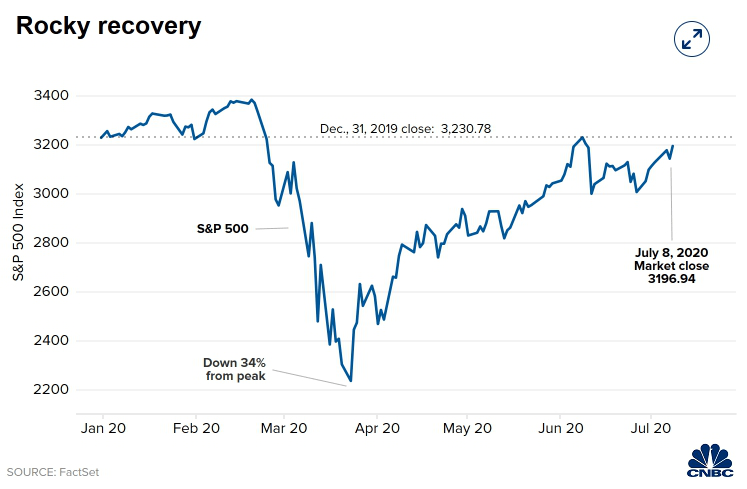

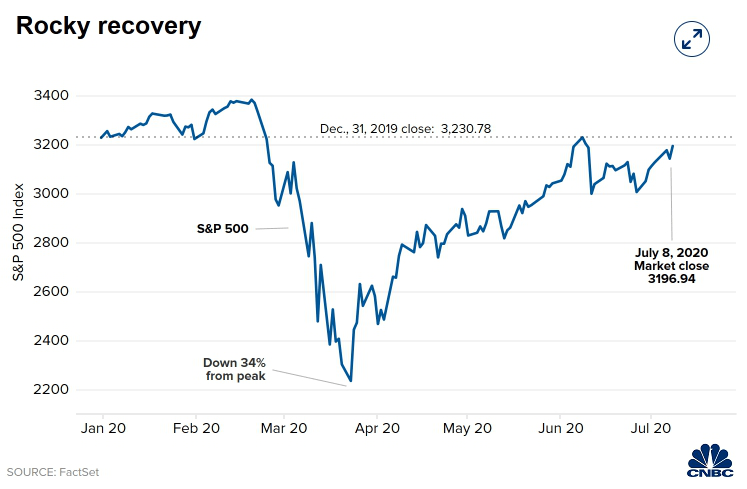

U.S stocks rose on Wednesday and the Nasdaq hit a record closing high, supported by technology shares as early signs of an economic rebound offset concern about further lockdowns due to a jump in coronavirus cases across the country.

The Dow Jones Industrial Average .DJI rose 177.1 points, or 0.68%, to 26,067.28, the S&P 500 .SPX gained 24.62 points, or 0.78%, to 3,169.94 and the Nasdaq Composite .IXIC added 148.61 points, or 1.44%, to 10,492.50.

· Stock futures point to 0.2% gain after Nasdaq clinches new record

Futures contracts tied to the major U.S. stock indexes rose during the overnight session Wednesday evening just hours after the Nasdaq Composite clinched its 25th record close for 2020.

Dow Jones Industrial Average futures climbed 24 points, implying an opening gain of 0.2% when regular trading resumes on Thursday. S&P 500 and Nasdaq-100 futures pointed to similar opening climbs of 0.2% each.

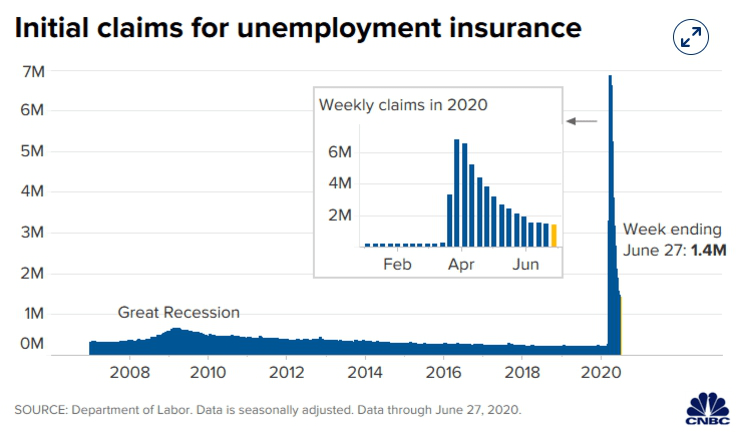

The latest iteration of the Labor Department report on weekly jobless claims will be released Thursday morning.

Another 1.39 million workers are expected to have filed first-time claims for state unemployment benefits during the week ended July 4. That would mark a deceleration from the prior week, though still well above any reading prior to the pre-Covid era.

· European stocks close lower as coronavirus cases temper recovery hopes

European markets closed lower Wednesday as surging coronavirus cases in parts of the world continue to cast doubt over the prospect of a global economic recovery.

The pan-European Stoxx 600 closed down by 0.7%, with autos shedding 2% to lead losses as almost all sectors and major bourses slid into negative territory.

Meanwhile, the White House has begun the process of formally withdrawing from the World Health Organization as worldwide cases pass 11.8 million. A WHO official said Tuesday that it shouldn’t “be a surprise” if coronavirus deaths start to rise again.

International Monetary Fund (IMF) Chief Economist Gita Gopinath warned on Tuesday that many countries may need to restructure their debt in the aftermath of the pandemic as borrowing surges.

· Asia Pacific stocks mostly higher as investors await China’s June inflation data

Shares in Asia Pacific were mostly higher in Thursday morning trade as investors await the release of Chinese inflation data.

The Nikkei 225 in Japan rose 0.27% in early trade as shares of conglomerate Softbank Group soared more than 4%. The Topix index, however, slipped 0.1%.

Over in South Korea, the Kospi advanced 0.71%. Australia’s S&P/ASX 200 gained 0.79%.

Overall, the MSCI Asia ex-Japan index traded 0.27% higher.

Chinese June inflation data is set to be released later on Thursday, with the Consumer Price Index (CPI) and Producer Price Index (PPI) for that month expected to be out at around 9:30 a.m. HK/SIN.

Reference: CNBC, Reuters