· Asian stocks make cautious gains, dollar languishes near two-year lows on Fed

Asian stocks were boosted on Thursday by the promise of ultra-easy monetary policy globally as the U.S. Federal Reserve pledged to support the country’s virus-battered economy, though record-shattering COVID-19 cases tempered gains.

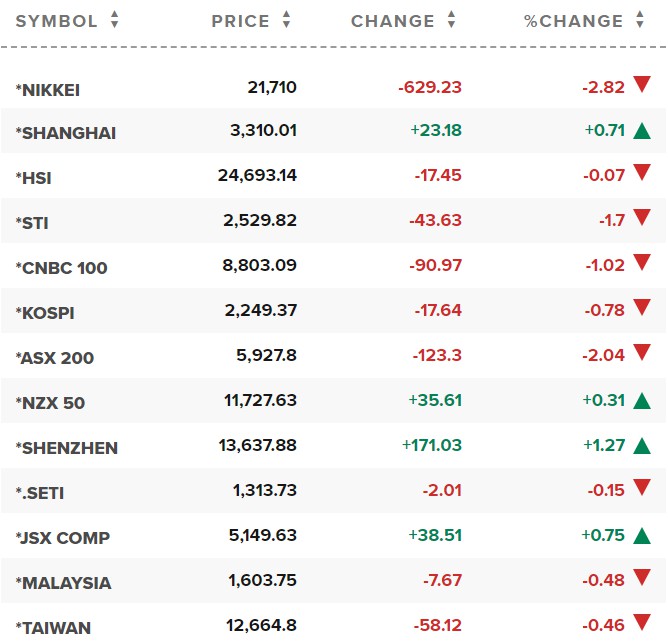

That left MSCI’s broadest index of Asia Pacific shares outside of Japan .MIAPJ0000PUS up 0.3%.

A U.S. stalemate over the next fiscal stimulus package together with a surge in novel coronavirus cases in the world’s largest economy had investors on the backfoot.

Cases have also spiked this week in Asia with Australia, India, Vietnam, and North Korea all on high alert.

On Wednesday, all Fed members voted as expected to leave the target range for short-term rates between 0% and 0.25%, where it has been since March 15 when the virus was beginning to hit the nation.

The unchanged policy setting together with a pledge the Fed would use its "full range of tools" if needed boosted risk appetite overnight with all three Wall Street indexes finishing firmer. .IXIC .DJI .SPX

Indeed, negotiations for a new coronavirus relief package in the United States have become a pressing issue for investors.

U.S. President Donald Trump said on Wednesday that his administration and Democrats in Congress were still “far apart” on a new coronavirus relief bill.

· Japanese shares end lower as virus worries cloud sentiment

Japanese shares reversed course to end lower on Thursday, as renewed concerns about rising cases of the novel coronavirus in Japan outweighed optimism around U.S. Federal Reserve’s decision and upbeat earnings reports.

The Nikkei 225 index ended down 0.26% at 22,339.23, while the broader Topix lost 0.62% to 1,539.47.

Sentiment turned sour after the Nikkei daily reported Tokyo plans to urge shorter operating hours for restaurants and karaoke parlours next month, a day after daily new cases crossed the 1,000-mark for the first time in Japan.

Markets had risen in early trade, tracking a Wall Street rally after the U.S. Federal Reserve repeated a pledge to use its “full range of tools” to support the economy and kept the interest rates near zero.

· China shares end lower on profit-taking; tech, resources lead slide

China shares closed lower on Thursday, with tech and resources shares leading the declines, as some investors booked profits following the market’s strong finish in the previous session.

The blue-chip CSI300 index ended down 0.5% to 4,656.15 and the Shanghai Composite Index 0.2% to 3,286.82.

Stocks were steady in morning trading, after the U.S. Federal Reserve’s pledge to limit damage from the pandemic lifted sentiment across global equity markets.

But signs of profit-taking gathered pace after the midday break, piling pressure on a market that jumped over 2% on Wednesday due to bargain-hunting. The tech-heavy STAR Market <STAR 50>, which surged 5.5% on Wednesday, lost 0.3%.

· European markets retreat with earnings in focus; Volkswagen shares drop 4%

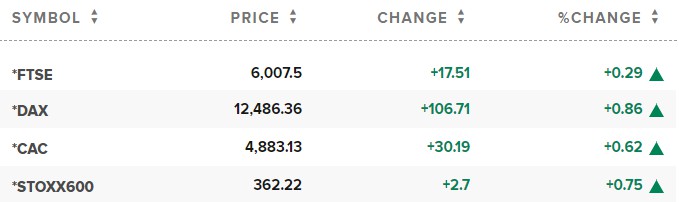

European markets pulled back Thursday morning after the U.S. Federal Reserve held interest rates steady, while investors are also reacting to a slew of major corporate earnings.

The pan-European Stoxx 600 slipped 0.7% in early trade, with banks and autos both shedding 1.8% to lead losses while the food and beverage sector edged 0.2% higher.

Some market focus also remains attuned to the state of the pandemic, with Brazil reporting a daily record 69,000 new cases on Wednesday, while deaths from the virus in the U.S. have risen for three consecutive weeks and fresh spikes have been seen parts of China, Australia and mainland Spain.

Corporate earnings will be high on investors’ agenda Thursday. Credit Suisse reported a 24% increase in net income before the opening bell and made additional provisions amid a “challenging economic environment,” along with announcing several structural changes. The Swiss lender’s shares gained 1.5%.

Volkswagen cut its dividend after reporting a first-half operating loss of 800 million euros ($940 million) amid a 27% plunge in vehicle deliveries due to the coronavirus pandemic, while French rival Renault slumped to a 7.3 billion euro net loss in the first half of the year. Volkswagen and Renault shares were down 4% and 0.8% respectively in early trade.

Reference: CNBC, Reuters