European markets close lower as U.S.-China tensions weigh; Pandora down 7.5%

European stocks closed lower Tuesday as a choppy start to the week’s trading continued, with investors monitoring the coronavirus pandemic and rising tensions between the U.S. and China.

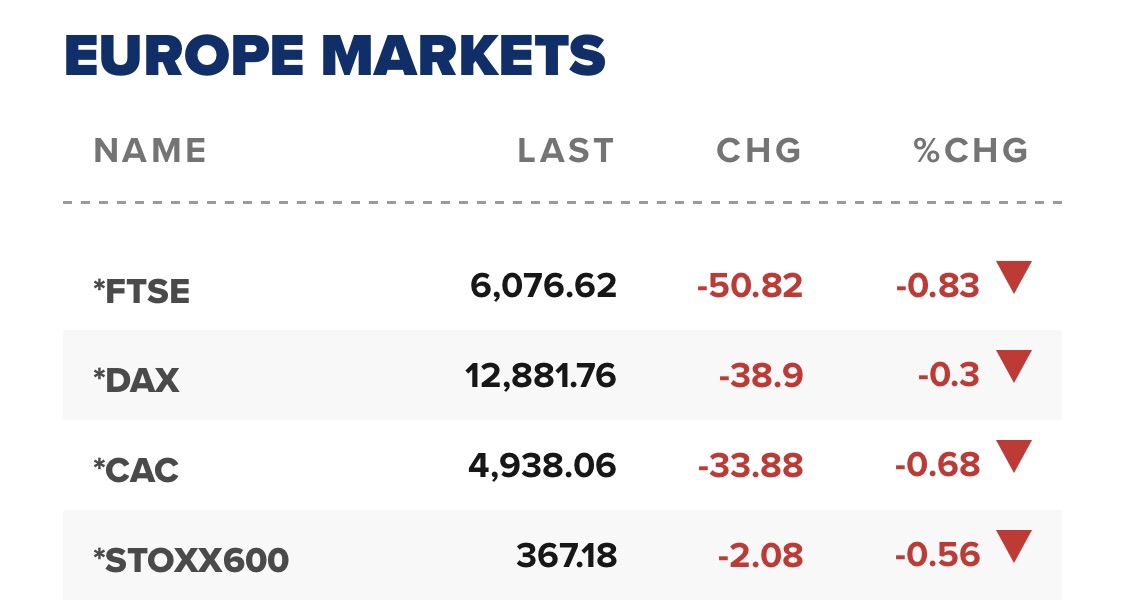

The pan-European Stoxx 600 gave up its earlier gains and fell 0.6% for the session, with bank stocks falling 1.1% and oil and gas firms slipping 1.3%.

Market participants monitored the latest developments in the U.S.-China technology war. On Monday, President Donald Trump’s administration moved to further tighten restrictions on Huawei by effectively cutting the telecommunications giant off from chips made by foreign firms that have been produced with U.S. software or technology.

Investors also kept a close eye on U.S. pressure on Bytedance, the Chinese owner of popular social media app TikTok. Last week, Trump signed an executive order giving the company more time to figure out a sale of its U.S. TikTok business.

Pandora shares fall

In earnings news, Pandora shares fell 7.5% to the bottom of the Stoxx 600 after the Danish jeweler published full-year guidance showing a more substantial earnings drop than expected.