Asian stocks pause for breath after Wall Street's record run

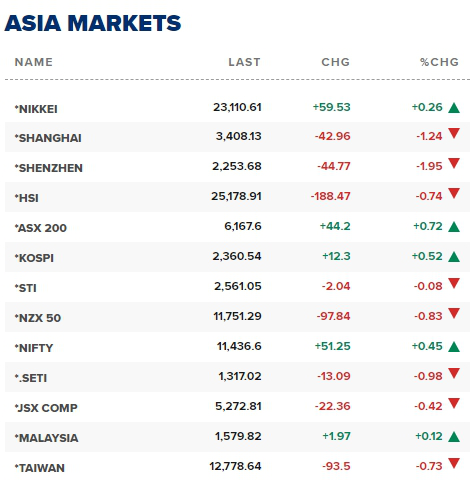

A gauge of Asian shares eased on Wednesday led by losses in Chinese and Hong Kong stocks, though it was still near a seven-month peak, driven by ever expanding policy stimulus aimed at cushioning the blow from the coronavirus pandemic.

E-Minis for the S&P 500 were last up 0.15%.

Asian shares had started the day on a positive note too before profit taking emerged in Chinese and Hong Kong shares.

MSCI’s broadest index of Asia-Pacific shares outside of Japan snapped two straight days of gains, dipping 0.1% after earlier hitting a high of 571.33 points, a level not seen since late January.

China’s blue-chip index slipped 1% following a strong rally in recent days, while Hong Kong’s Hang Seng was off 0.9%.

Australian shares finished 0.8% higher and South Korea added 0.8%. Japan’s Nikkei rose 0.25%.

While emerging markets found some support from the low-yielding environment and a weaker U.S. dollar, worries about the economic hit from the pandemic kept investors jittery, analysts said.

· European markets slightly higher after record highs on Wall Street; Maersk up 5.4%

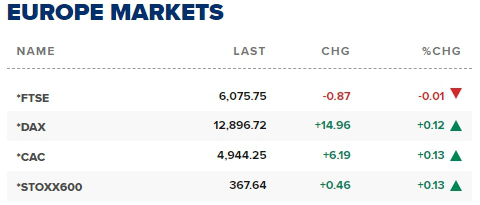

European stocks advanced slightly on Wednesday morning, pausing after a strong session stateside that saw the S&P 500 hit a fresh record high.

The pan-European Stoxx 600 edged 0.2% higher, having fluctuated at the start of trading. Oil and gas stocks shed 0.2% while telecoms gained 0.6%.

Market participants in Europe tentatively followed the positive sentiment on Wall Street, where the S&P 500 and Nasdaq Composite set records. The S&P 500 rose to an all-time high Tuesday, wiping out all its losses from the market sell-off caused by the coronavirus pandemic. It confirms the start of a new bull market.

Reference: CNBC, Reuters