· S&P 500 struggles to extend record run after Fed minutes, still bullish

S&P 500 hit new record of 3399.54 but retreated mildly after FOMC minutes, closing down -0.44% at 3374.85. Upside momentum appears to be diminishing as the index presses prior record of 3393.52. Daily MACD is struggling around signal line, in accordance with indecisive price actions.

For now, outlook will remain bullish as long as 3279.99 resistance turned support holds. An eventual firm break of 3393.52 and a record run is still in favor. But break of this first line of defence will be a strong sign of rejection by 3393.52 resistance. Focus will then turn to 55 day EMA (now at 3209.72), for further indication of near term bearish reversal.

· Asian stocks slump, gold jumps after dovish Fed

Asian equities and U.S. futures fell on Thursday, hurt by the U.S. Federal Reserve’s cautious view of the economy, tensions with China and new clusters of coronavirus infections.

MSCI’s broadest index of Asia-Pacific shares outside Japan slid 1.79%, the biggest daily decline in five weeks. U.S. stock futures were down 0.55%.

· Tokyo stocks sink on worries over US economic recovery

Tokyo stocks sank Thursday as uncertainty about the U.S. economic recovery increased based on opinions in the minutes of the Federal Reserve's July policy meeting released overnight.

The 225-issue Nikkei Stock Average ended down 229.99 points, or 1.00 percent, from Wednesday at 22,880.62. The broader Topix index of all First Section issues on the Tokyo Stock Exchange finished 14.53 points, or 0.90 percent, lower at 1,599.20.

Decliners were led by electric appliance, real estate and metal product issues.

· Shanghai shares fall most in four weeks on fading stimulus hopes

The Shanghai stock market dropped the most in four weeks on Thursday after the country kept a key interest rate steady and as expectations of further policy support from Beijing dwindled.

The Shanghai Composite index fell 1.3% to close at 3,363.90, marking its worst day since July 24.

The blue-chip CSI300 index also fell 1.3%, with its financial sector sub-index down 1.3%, the real estate index down 0.3% and the healthcare sub-index down 0.8%.

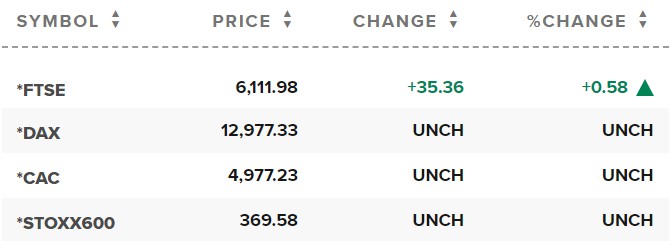

· European markets fall after Fed flags uncertainty of U.S. recovery

European stocks opened lower Thursday morning after the U.S. Federal Reserve struck a pessimistic tone over the country’s economic recovery prospects.

The pan-European Stoxx 600 fell 1.2% at the start of trading, with basic resources shedding 2.5% to lead losses as all sectors and major bourses slid into negative territory.

Reference: CNBC, Reuters