· Dollar bounce falters in Asia as Fed shock fades

The dollar clung to gains on Thursday, after minutes from last month’s U.S. Federal Reserve meeting gave few clues about whether an even more dovish shift in its policy framework is possible in the autumn, disappointing some dollar bears.

A heavily shorted greenback put on its biggest one-day surge since March after the release, hitting 93.159 against a basket of currencies, about 1% above Tuesday’s two-year trough.

But in the wash up, it couldn’t extend the bounce, and other majors mostly nursed their losses during the Asia session with little spillover from a sharp sell down in equities.

Exceptions included the Korean won, which dropped 0.4% along with a tumble on the Kospi share index, and the Thai baht, which hit a three-week low of 31.44 per dollar as investors started to worry about anti-government protests.

The euro – the most stretched of all recent gainers on the greenback - fell back below $1.19 and last sat at $1.1849. The pound was dumped back to $1.3106 and the dollar jumped about 0.7% on the yen to 106.00.

“Traders were hoping (the minutes) would cement a clear consensus in the Fed’s ranks for a series of key changes in the 18 September meeting,” said Chris Weston, head of research at broker Pepperstone in Melbourne.

″(But) there seems little consensus in the Fed collective to adopt an inflation-targeting regime, which is what so many have positioned for.”

For the Fed itself, the focus now shifts to whether more will be revealed at the August 27 to 28 virtual Jackson Hole symposium or at September’s meeting.

Elsewhere the Chinese yuan was steady after China kept benchmark interest rates steady, as expected. It last changed hands at 6.9218 per dollar in onshore trade.

· Treasury yields retreat after Fed flags recovery fears

U.S. government debt prices were higher Thursday morning after the Federal Reserve revealed concerns about the uncertainty of the country’s economic recovery.

At around 1:50 a.m. ET, the yield on the benchmark 10-year Treasury note was down at 0.6590% and the yield on the 30-year Treasury bond fell to 1.3935%. Yields move inversely to prices.

· Jobless claims preview: Another 920,000 Americans expected to have filed unemployment claims last week

The number of individuals filing new unemployment insurance claims is expected to have come in below the 1 million mark for a second straight week last week, reflecting a still-elevated but somewhat improving level of joblessness in the US economy.

The Labor Department is set to release its report on weekly unemployment insurance claims Thursday at 8:30 a.m. ET. Here were the main metrics expected from the report, compared to consensus estimates compiled by Bloomberg as of Wednesday morning:

Initial jobless claims, week ended Aug. 15: 920,000 expected vs. 963,000 during the prior week

Continuing claims, week ended Aug. 8: 15 million expected vs. 15.486 million during the prior week

· U.S. economy rebounding strongly; fresh aid coming to unemployed: Kudlow

The U.S. economy is rebounding “very, very strongly,” and fresh federal aid will reach unemployed Americans in the next week or two, White House economic adviser Larry Kudlow said on Wednesday, shaking off concerns about a second wave of COVID-19 infections.

Kudlow, speaking to reporters at the White House, defended a reduction in the unemployment supplement to $300 from $600, saying stimulus measures should be reduced slowly as the economy strengthens.

“I think the economy is on a self-sustaining recovery and it’s a V-shaped recovery,” he said. “We’re seeing terrific numbers.”

Asked about concerns that a second wave of coronavirus infections this autumn and winter could derail the recovery, Kudlow said: “The hope is that the decline in cases and fatalities will continue. That’s the great hope.”

· U.S. and China to hold trade talks in the coming days, Chinese commerce ministry says

The U.S. and China have agreed to go back to the negotiating table in the coming days to review the progress of their “phase one” trade deal, according to the Chinese commerce ministry.

Both sides will hold the “discussion over the phone,” the ministry said. It comes after talks scheduled for last Saturday were postponed due to a scheduling conflict, according to Reuters.

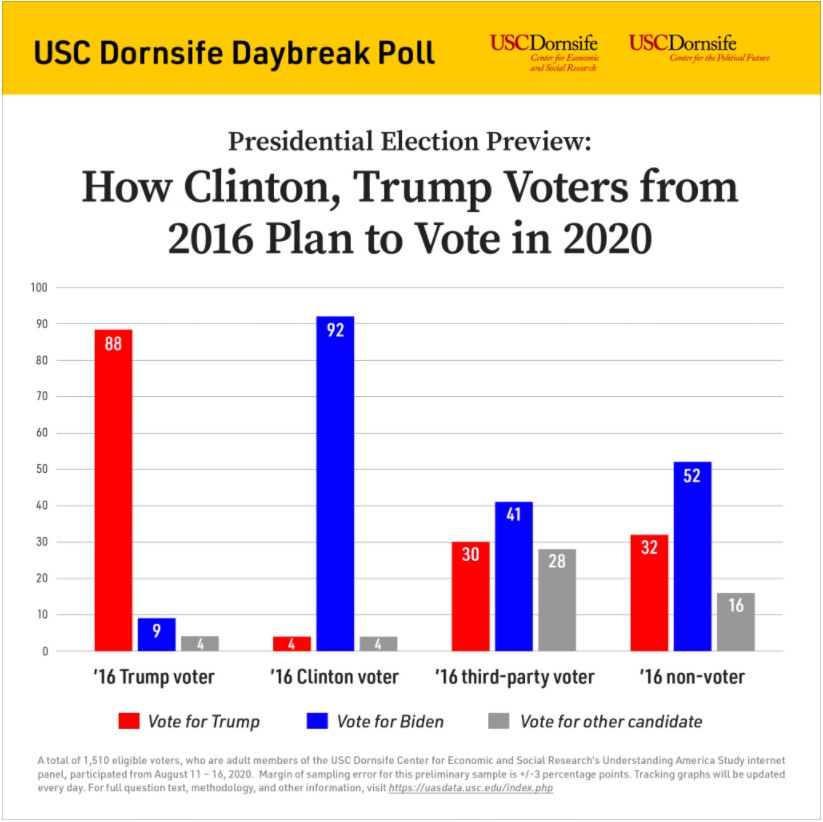

· USC Dornsife launches 2020 election tracking poll; Biden leads by 11 points

The year’s version of USC’s groundbreaking Daybreak Poll will provide three ways to estimate how Americans may vote in the 2020 presidential election.

USC researchers will base election forecasts on an updated version of methods used in their groundbreaking 2016 election poll, which tracked crucial inflection points in the election by following the same individuals over time. Data from the 2016 USC poll suggested late-breaking support among certain groups that contributed to Donald Trump’s surprise win in the electoral college.

The first full release of findings from the poll will be in late August, in which researchers will examine the impact of the pandemic on voters and take a look at differences between voting blocs in 2016 and 2020. An early peek at preliminary data among roughly 1,500 respondents who participated from Aug. 11-16, using the poll’s signature probability method, finds Democratic nominee Joe Biden holding an 11 point lead over President Trump.

· 2020 Daily Trail Markers: 90% of Black likely voters back Biden, CBS Battleground Tracker poll finds

Our recent nationwide Battleground Tracker poll fielded just before the Democratic Convention shows that 90% of Black likely voters nationwide plan to cast their ballot for Joe Biden.

· Euro zone economic outlook steady but job recovery at high risk: Reuters Poll

A full bounceback from the euro zone’s deepest recession on record will take two years or more, according to a Reuters poll of economists who also said there is a high risk the job recovery underway reverses by the end of 2020.

Europe was badly hit earlier this year by the coronavirus pandemic, which has now infected more than 22 million people globally. But stringent lockdowns and contact tracing helped get the numbers down and allowed swift re-openings.

Along with trillions of euros’ worth of European Central Bank stimulus and a 750 billion euro European Union recovery fund that kicks in next year, sentiment has improved, and the economy is bouncing back along with the euro.

The consensus from the Aug 14-19 Reuters poll points to 8.1% growth this quarter compared with the previous one, easily the fastest on record, following a historic 12.1% contraction in Q2. That is unchanged from the July poll median.

In May, around the time lockdowns were lifted in most euro zone countries, the Q3 forecast was for 7.2% growth.

Quarterly growth will then slow sharply to 3.0% in Q4, slightly better than the 2.8% predicted last month and still a historically robust rate.

However, more than 70% of economists, or 25 of 35 who replied to an additional question, said it would take two or more years for euro zone GDP to reach pre-COVID-19 levels. Ten respondents said within two years and none said within a year.

On an annual basis, the economy was expected to shrink 8.2% this year and then grow 5.5% next, or -10.3% this year and no growth in 2021 on a worst-case basis.

Much will depend on how the job market performs from now on.

· Covid-19 vaccine won't be mandatory in US, says Anthony Fauci

Anthony Fauci, the United States' top infectious diseases official, said Wednesday the government wouldn't make any future Covid-19 vaccine obligatory for the general public - though local jurisdictions could make it mandatory for some groups, like children.

"You don't want to mandate and try and force anyone to take a vaccine. We've never done that," said Fauci, a member of the White House coronavirus task force, during a video talk organized by George Washington University.

· Australia's Vaccine Deal with Oxford May Be Premature

There’s a risk the vaccine may not fully protect against COVID-19 in humans. It still needs to pass through phase 3 trials, which are currently recruiting and expecting results at the end of the year. So we can’t get too excited yet.

Prime Minister Scott Morrison announced on Wednesday the Australian government has signed a letter of intent to procure the University of Oxford’s vaccine for SARS-CoV-2 (the virus that causes COVID-19) and to provide it free to all Australians.

All the signs are promising so far, as the vaccine has been shown to provoke an immune response in humans and hasn’t yet caused serious side effects.

· New Zealand reports five new confirmed cases of coronavirus

New Zealand on Thursday reported five new confirmed cases of coronavirus in the last 24 hours compared with six a day earlier, as the Pacific nation battles a fresh outbreak in its biggest city of Auckland.

An abrupt resurgence of infections last week in Auckland prompted the government to reimpose some lockdown restrictions on the city’s 1.7 million residents.

New Zealand so far has reported just over 1,300 confirmed cases and 22 deaths from the virus. There are 101 active cases in the country.

· China keeps benchmark lending rate steady for fourth straight month, in line with expectations

China kept its benchmark lending rate for corporate and household loans steady as expected for the fourth straight month at its August fixing on Thursday.

The one-year loan prime rate was kept unchanged at 3.85%, while the five-year LPR remained at 4.65%.

Most new and outstanding loans are based on the LPR, while the five-year rate influences the pricing of mortgages.

· North Korea to set new five-year plan in January as economy struggles

North Korea’s ruling party will hold a congress next year to decide a new five-year plan, state media reported on Thursday, after a party meeting noted serious delays in improving the national economy and living standards.

The meeting comes as the isolated country deals with international sanctions, struggles to cope with damage from recent flooding and faces significant economic damage from strict border closures and other measures aimed at preventing a coronavirus outbreak.

· Oil falls amid demand threat, lower-than-expected drop in stockpiles

Oil prices fell on Thursday as major producers warned of a risk to demand recovery if the coronavirus crisis is prolonged, while U.S. crude inventories dropped less than expected.

Brent crude LCOc1 was down 34 cents, or 0.8%, at $45.03 a barrel by 0732 GMT. U.S. oil CLc1 was down 36 cents, or 0.8%, at $42.57 a barrel.

Stockpiles of crude in the United States fell a fourth straight week, even as net imports rose, the Energy Information Administration (EIA) said on Wednesday. However, the 1.6 million-barrel decline for the week to Aug. 14 was less than a Reuters poll showing expectations for a 2.7 million-barrel fall.

Fuel demand was down 14% from the year-earlier period over the last four weeks, the EIA data also showed. [EIA/S]

Reference: CNBC, Reuters, AFP, News.USC.edu, CBS News, Yahoo, CNBC