· Dollar drifts ahead of key Fed speech as economic worries grow

The dollar held steady against most currencies on Wednesday as traders braced for U.S. data expected to show a slowdown in durable goods orders and a key speech by Federal Reserve Chairman Jerome Powell.

The yuan rose toward a seven-month high after U.S. and Chinese trade officials reaffirmed their commitment to a phase one trade deal, which eased concerns about a diplomatic standoff between the world’s two-largest economies.

The greenback took a hit after data on Tuesday showed U.S. consumer confidence tumbled to the lowest in more than six years due to concerns about coronavirus-induced job losses.

Traders will look to Powell’s speech on Thursday at the annual Jackson Hole retreat to determine what steps the Fed is willing to take to safeguard a fragile economic recovery.

“I expect Powell to use forward guidance to send a dovish message that rates will remain low for a long time, which feeds into dollar weakness,” said Minori Uchida, head of global market research at MUFG Bank in Tokyo.

“You could say we are in a long-term correction of excessive dollar strength.”

Against the euro, the dollar stood at $1.1816 on Wednesday following a 0.4% decline in the previous session.

The British pound bought $1.3138 having risen 0.7% against the dollar on Tuesday.

Sterling has managed to shrug off a lack of progress in trade negotiations between Britain and the European Union.

The dollar was locked into a narrow range against the yen, last trading at 106.43.

Data later on Wednesday is forecast to show growth in U.S. durable goods orders slowed in July, following from the U.S. consumer confidence report for August, which fell to the lowest since May 2014 – highlighting policymakers’ concerns about the economy.

The onshore yuan rose to 6.9002 per dollar, approaching a seven-month high after Washington and Beijing affirmed their trade deal.

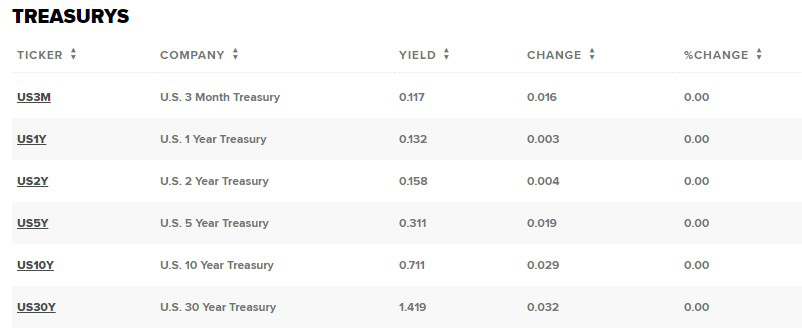

· Treasury yields move higher as stocks lose some momentum

U.S. government debt prices were lower on Wednesday morning as market participants awaited a speech from Jerome Powell.

At around 3:00 a.m ET, the yield on the benchmark 10-year Treasury note rose to 0.7177%, whereas the yield on the 30-year Treasury bond jumped to 1.4238%. Yields move inversely to prices.

The main focus is a speech due Thursday by Federal Reserve Chairman Jerome Powell, who traders will be looking to for clues over future monetary policy decisions.

In the meantime, markets remain focused on coronavirus developments and news of further trade talks between the U.S. and China, which resumed Tuesday.

· India's coronavirus cases top 3.2 million

· Germany's confirmed coronavirus cases rise by 1,576 to 236,429: RKI

The number of confirmed coronavirus cases in Germany increased by 1,576 to 236,429, data from the Robert Koch Institute (RKI) for infectious diseases showed on Wednesday.

The reported death toll rose by three to 9,280, the tally showed.

· Myanmar reports biggest daily rise in coronavirus infections

Myanmar reported 70 new coronavirus infections on Wednesday, the Southeast Asian nation’s biggest daily rise, amid a recent resurgence of the virus after weeks without confirmed domestic transmission.

Myanmar’s outbreaks has been relatively small compared with other countries in the region after it found its first case in March, with only six deaths and 574 infections reported so far.

· Australian coronavirus antibody therapy aims for trial in early 2021

Australian researchers hope to start human trials of a coronavirus antibody therapy in early 2021, while a large-scale trial of a vaccine could begin by the end of this year, scientists said on Wednesday.

The research targets came as the country’s virus hotspot, Victoria state, recorded its second-most deadly day of the pandemic with 24 deaths. Just 149 new cases were reported, well down from daily rises of more than 700 about three weeks ago.

Melbourne’s Walter and Eliza Hall Institute has made good progress in identifying the most potent antibodies that could neutralise the spike protein on the virus that causes COVID-19, stopping it from being able to enter human cells, researcher Wai-Hong Tam said.

Antibody therapies would be most useful for the elderly and people with weakened immune systems, she said.

Almost 64% of Australia’s 549 deaths from COVID-19 have occurred among residents of aged-care homes, mostly in Victoria.

“If we’re very hopeful, we are looking at clinical trials early next year,” Tam told reporters.

· Australia boosts defence spending in latest COVID-19 stimulus

Australia will boost defence spending by A$1 billion ($716.80 million) to upgrade military facilities and offer additional paid employment to army reservists, as Canberra seeks to soften the economic blow of COVID-19.

In a fresh round of stimulus, Prime Minister Scott Morrison on Wednesday promised greater spending on defence in a bid to grow the country’s military and support 4,000 jobs.

· French government to unveil economic recovery plan on September 3: PM

· Second wave of coronavirus could hit France in November: government advisor

A second wave of the coronavirus pandemic could hit France in November, a government advisor told local media on Wednesday, as the city of Marseille tightened restrictions to fight the outbreak.

Authorities in Marseille said late on Tuesday that bars and restaurants would have shorter opening times, and they also broadened mandatory mask-wearing in the southern port city between Aug. 26 and Sept. 30.

· Japan govt. spokesman says it is premature to talk about post-Abe era

It is too early to talk about the next political era after Japan’s Prime Minister Shinzo Abe because his term runs until next year, a top spokesman said on Wednesday, amid worries about Abe’s ability to continue as premier after two hospital visits.

“It’s premature to talk about ‘post-Abe’ as he still has over a year left in his term,” Chief Cabinet Secretary Yoshihide Suga told a regular news conference.

· An economic decoupling of the U.S. and China is ‘a long way away,’ says former IMF China head

An economic decoupling of the U.S. and China is “a long way away,” but moving away from a U.S.-centric system certainly appeals to Beijing, said Eswar Prasad, previously head of the International Monetary Fund’s China division.

“These two economies are still quite closely tied. After all, it’s very hard for the two largest economies in a way to stop bumping into each other in various dimensions,” said Prasad, who is now a trade professor at Cornell University.

However, “the desire to get away from the grasp of the U.S.-based or dollar-denominated international financial system is certainly something at the forefront of China’s mind,” said Prasad.

That is why the world’s second-largest economy has been pushing for greater use of the Chinese yuan in settling trade, he said.

China is also actively opening up its capital markets to foreign investors and liberalizing its exchange rate regime.

· China protests U.S. spy plane watching drills

China has lodged “stern representations” with the United States, accusing it of sending a U.S. U-2 reconnaissance plane into a no-fly zone over Chinese live-fire military drills on Tuesday, further ratcheting up tensions between Beijing and Washington.

China has long denounced U.S. surveillance activities, while the United States has complained of “unsafe” intercepts by Chinese aircraft. While such missions happen regularly, for China to talk about them publicly is unusual.

China’s Defense Ministry said the U-2 flew without permission over a no-fly zone in the northern military region where live fire drills were taking place, “seriously interfering in normal exercise activities”.

· Brent prices climb on U.S. output cuts, China trade deal hopes

Brent crude oil prices rose on Wednesday, lifted by U.S. producers shutting most of their offshore output in the Gulf of Mexico ahead of Hurricane Laura and optimism over China-U.S. trade talks.

But gains were capped amid renewed concern over the coronavirus pandemic, which has squeezed fuel demand, after reports from Europe and Asia of patients being re-infected with COVID-19, raising concerns about future immunity.

Brent crude oil futures LCOc1 added 10 cents, or 0.2%, to $45.96 a barrel by 0642 GMT, while U.S. West Texas Intermediate crude CLc1 fell 5 cents, or 0.1%, to $43.30 a barrel. Both benchmarks settled at a five-month high on Tuesday.

Reference: CNBC, Reuters