· SoftBank to slash holding in wireless carrier to 40.4%; could raise $14 billion

SoftBank Group Corp (9984.T) said on Friday it planned to slash its exposure to wireless carrier SoftBank Corp (9434.T) to 40.4% from 62.1% now, in a sale worth 1.47 trillion yen ($13.8 billion) at Friday’s closing price.

The offer price for the 1.02 billion shares, including over-allotment, will be set between Sept. 14-16.

SoftBank Corp shares closed down 1.6% at 1,431 yen on Friday.

SoftBank CEO Masayoshi Son has been selling down the group’s core assets to stabilise its balance sheet amid the coronavirus pandemic.

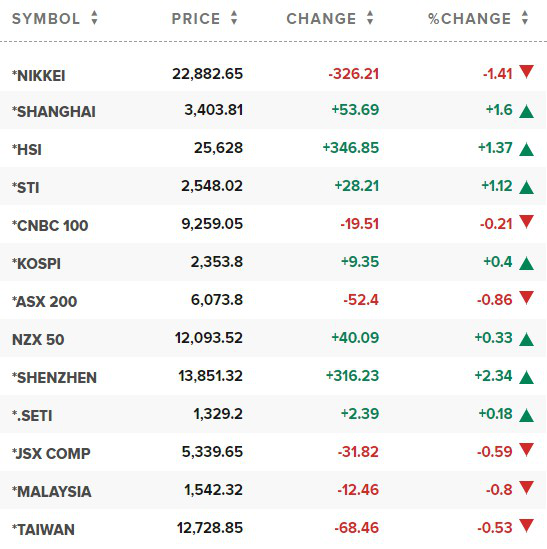

· Nikkei tumbles on likely end of 'Abenomics'

Japanese shares fell on Friday by their most in almost a month on news Prime Minister Shinzo Abe will resign, bringing an abrupt end to his stable government and policy mix of aggressive monetary and fiscal stimulus dubbed Abenomics.

The Nikkei share average declined 2.65% at one point before closing 1.41% lower at 22,882.65.

· China stocks climb on upbeat economic data, listings momentum

The Chinese stock market climbed on Friday, with blue-chip shares clocking their best week in four, as sentiment was supported by improving economic data and a slew of new listings.

The Shanghai Composite index closed up 1.6% at 3,403.81. The blue-chip CSI300 index jumped 2.4%. ** Stocks clung on to a momentum this week that was fuelled by upbeat data showing improving industrial profits and a surge in the start-up Chinext board.

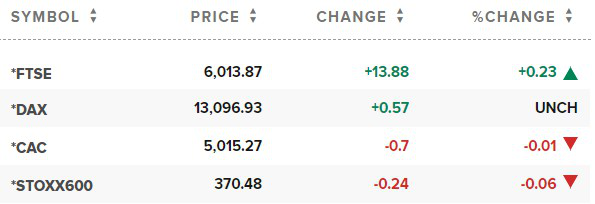

· European equities move lower following Fed policy shift; Japan’s Abe reportedly set to resign

European stocks fell in early trade Friday as investors digested a major policy shift by the U.S. Federal Reserve and reports that Japanese Prime Minister Shinzo Abe is set to resign.

The pan-European Stoxx 600 dropped 0.48%, with most sectors trading in the red.

Reference: CNBC, Reuters