· Dollar sold broadly as bearish mood weighs on rates outlook

The dollar fell toward multi-year lows against most major currencies on Tuesday as as investors stepped up bets that the Federal Reserve’s new policy framework meant U.S. rates would stay lower than rates in other countries.

The Australian dollar held around a two-year high against the greenback after the Reserve Bank of Australia kept policy unchanged and expanded its cheap funding for banks.

The yuan was another strong performer, brushing off concerns about diplomatic tension over Taiwan to surge to its strongest in more than a year against the greenback.

The U.S. data calendar this week is full of important releases on manufacturing, durable goods, and employment, but positive results are unlikely to halt the dollar’s decline due to strong expectations that rates will remain extremely low.

Against the euro, the dollar fell to $1.1997 on Tuesday to reach its lowest since May 2018.

The British pound rose to $1.3413, the highest since December last year, after Japan’s foreign minister said a broad agreement on a Japan-UK trade deal is close.

The dollar was quoted at 0.9006 Swiss franc, just a shade above the lowest in more than five years.

The greenback eased slightly to 105.75 yen.

Against a basket of six major currencies, the dollar index slid on Monday to a two-year low at 91.775.

The yen was in focus as investors place bets on who will become Japan’s new prime minister.

The largest faction in the ruling Liberal Democratic Party has thrown its support behind Yoshihide Suga, who currently serves as chief cabinet secretary.

Suga is a close ally of Abe and is likely to continue many of Abe’s policies if he becomes the new prime minister.

The RBA left its cash rate at a record low of 0.25% on Tuesday, but surprised by expanding a program of cheap funding for banks and extending it out to the middle of 2021.

The onshore yuan surged to 6.8181, the highest in more than a year.

The dollar also fell broadly against other emerging Asian currencies, further underlining the greenback’s woes.

The yuan brushed aside increasing tension between the United States and China in the run up to this year’s U.S. presidential election in November.

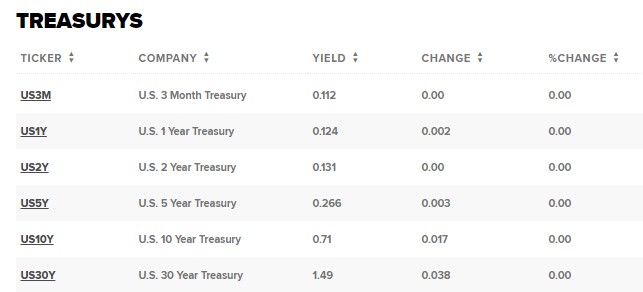

· U.S. Treasury yields move higher ahead of consumer spending data

U.S. government debt prices were lower Tuesday morning as markets entered their first trading day of the month.

At around 2:25 a.m. ET, the yield on the benchmark 10-year Treasury note rose to 0.7081%, while the yield on the 30-year Treasury bond jumped to 1.4832%. Yields move inversely to prices.

Investors are monitoring coronavirus’ news, but also possible moves to monetary policy, after the U.S. Federal Reserve said last week it was willing to let inflation surpass the 2% threshold for some time as it worked to revamp the economy.

· U.S. increases support for Taiwan, says it’s to counter rising China pressure

The United States said on Monday it was establishing a new bilateral economic dialogue with Taiwan, an initiative it said was aimed at strengthening ties with Taipei and supporting it in the face of increasing pressure from Beijing.

Washington also said it had declassified six Reagan-era security assurances given to Taiwan, a move analysts said appeared intended to show further support for Taipei.

The announcements come at a time of increasing Chinese threats towards Taiwan, and when relations between Washington and Beijing have sunk to their lowest level in decades. U.S. President Donald Trump is campaigning for re-election in November with a tough approach to China among his key foreign policy platforms.

· · Euro zone unemployment rises to 7.9% despite reopening of economies

The unemployment rate has risen again in the euro zone as the impact of the coronavirus pandemic continues to be felt. Official figures Tuesday put the jobless rate in the region at 7.9% for the month of July.

It comes after the euro zone logged a revised unemployment rate of 7.7% in June. Thursday’s numbers show a deteriorating picture but are still below the record low seen in the midst of the sovereign debt crisis.

The euro area has been grappling with a severe economic recession in the wake of the coronavirus pandemic. The 19-member economy contracted by 12.1% in the second quarter of the year following strict lockdown measures to prevent further contamination. The contraction was the worst since records began in 1995, according to Eurostat.

· Asia's factories shaking off COVID gloom, China shines

Asian factories continued to shake off the coronavirus gloom in August as more bright signs in China raised hopes of a firmer recovery in global demand, reducing pressure on policymakers to take bolder steps to avert a deeper recession.

Manufacturing activity in China expanded at the fastest clip in nearly a decade in August, as factories ramped up output to meet rebounding demand, a private survey showed. New export orders rose for the first time this year.

The upbeat findings contrasted with an official survey on Monday, which showed China’s factory activity grew at a slightly slower pace in August.

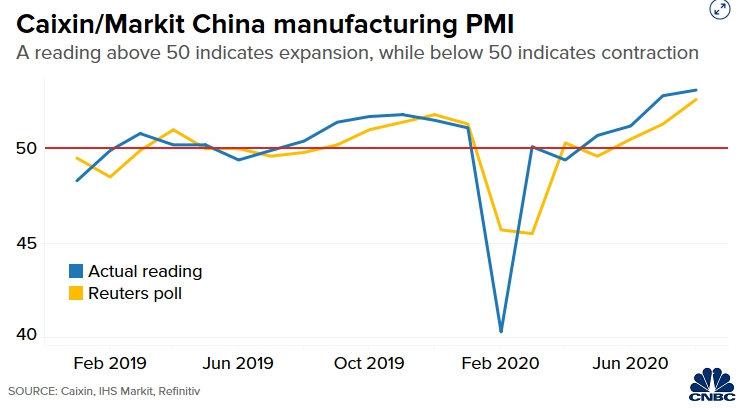

· A private survey shows China’s manufacturing sector expanded in August at the fastest pace in nearly a decade

Results of a private survey on Tuesday showed China’s manufacturing activity expanded in August at the fastest pace in nearly a decade.

The Caixin/Markit manufacturing Purchasing Managers’ Index (PMI) came in at 53.1 for August, compared to 52.8 in July.

Economists polled by Reuters had expected Caixin/Markit manufacturing PMI to come in at 52.7.

PMI readings above 50 indicate expansion, while those below that level signal contraction. The readings are sequential and indicate on-month expansion or contraction.

The expansion in August was the fastest since January 2011, Caixin and IHS Markit said in their joint report.

“Manufacturing demand and supply continued to recover, and overseas demand started to pick up,” wrote Wang Zhe, a senior economist at Caixin Insight Group.

· Japan's next premier to find pandemic eroding job market gains made by 'Abenomics'

Whoever succeeds Shinzo Abe as Japan’s prime minister will be confronted with growing signs that the job market is deteriorating in an economy laid low by the coronavirus pandemic.

Top government spokesman Yoshihide Suga is emerging as a front-runner to become next premier, heightening the chance the government will continue down the policy course set by Abe - notably the “Abenomics” strategy aimed at reviving the economy.

But the widening damage from COVID-19 is threatening job creation, among the few successes of Abenomics.

Japan’s unemployment rate crept up to 2.9% in July and job availability fell to a more than six-year low, data showed on Tuesday. Nearly 2 million people lost their jobs in July, about 410,000 more than in the same month last year, with the number of job losses rising for six straight months through July.

· India's coronavirus surge eases slightly as millions take exams, pubs reopen

· Nearly 3 in 4 adults plan to get vaccinated against the coronavirus, global survey shows

Around 74% of adults globally are wiling to get immunized against the coronavirus if a vaccine became available — but that may not be enough to defeat the fast-spreading virus, according to a survey released Tuesday.

The survey by World Economic Forum and market research firm Ipsos polled close to 20,000 adults across 27 countries over two weeks — between July 24 and Aug. 7 this year.

· Oil prices rise 1% as mood on dollar sours

Oil prices gained on Tuesday, reversing overnight losses, as investors moved into risk assets and stayed away from the safe-haven U.S. dollar which hit multi-year lows.

Brent crude LCOc1 futures climbed 47 cents, or 1%, to $45.75 a barrel at 0635 GMT. U.S. West Texas Intermediate (WTI) crude CLc1 futures rose 43 cents, or 1%, to $43.04 a barrel.

Both benchmark contracts fell around 1% on Monday on worries about oil oversupply, with global demand stuck below pre-COVID levels.

Reference: CNBC, Reuters