· E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – No Resistance as Momentum Trade Continues

September E-mini NASDAQ-100 Index futures rallied to another record high on Monday on the back of several high-flying technology stocks. The heavily weighted tech index is now trading more than 20% above its pre-crisis high. Its top two performers were Apple and Tesla Inc, which rallied after their previously announced stock splits.

On Monday, September E-mini NASDAQ-100 Index futures settled at 12114.00, up 122.25 or 1.01%.

Daily Swing Chart Technical Analysis

The main trend is up according to the daily swing chart. A trade through 12165 will signal a resumption of the uptrend on Tuesday.

The main trend will change to down on a move through the nearest swing bottom at 10845.50. This is highly unlikely, however, due to the prolonged move up in terms of price and time, the market is still vulnerable to a closing price reversal top. This chart pattern won’t change the main trend to down, but it could signal that the selling is greater than the buying at current price levels.

As of Monday’s close, the new minor range is 11221.50 to 12165.00. Its retracement zone at 11693.25 to 11582.00 is the first support zone.

The main range is 10845.50 to 12165.00. Its 50% level at 11505.25 is the second potential downside target.

· Asian stocks edge up after strong China manufacturing survey

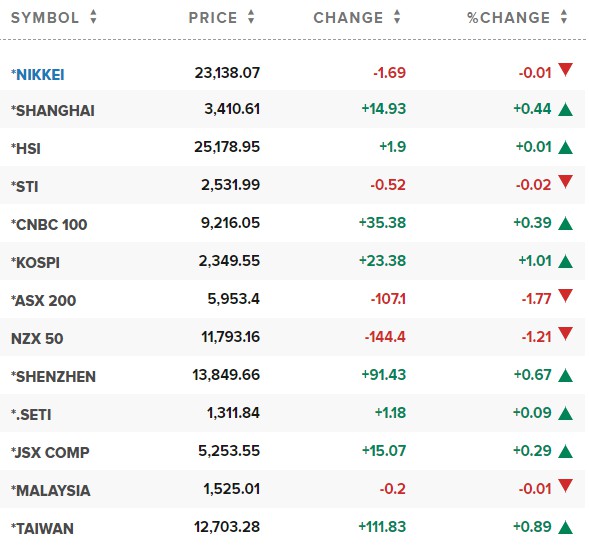

Asian stocks edged higher on Tuesday after strong readings on China’s vast manufacturing sector offset the weak lead from a softer Wall Street session.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.3%, to regain some ground lost on Monday.

The Hang Seng Index in Hong Kong traded 0.3% higher while the Shanghai Composite also recovered early losses to stand 0.1% higher. Japan’s Nikkei 225 erased early losses to trade flat.

The Caixin/Markit Manufacturing Purchasing Managers’ Index(PMI) showed China’s factory activity expanded at the fastest clip in nearly a decade in August, bolstered by the first increase in new export orders this year.

The strong reading shows activity in the worlds’ second-biggest economy is bouncing back, “as the world begins to come out of the enforced lockdown for the virus,” said Ben Powell, chief investment strategist for Asia Pacific at the BlackRock’s Investment Institute.

· Japanese shares close little changed, trading firms extend gains

Japanese stocks closed almost unchanged on Tuesday, as an extended rally in trading companies was offset by investors booking profits after a sharp rise in the last session.

The benchmark Nikkei share average was down 0.01% to 23,138.07, after flitting between positive and negative territories. There were 72 advancers against 146 decliners.

The broader Topix fell 0.15% to 1,615.81, with all but eight of 33 sectoral sub-indexes on the Tokyo exchange trading lower.

Shares of trading firms extended a rally driven by the acquisition of a 5% stake by Warren Buffett’s Berkshire Hathaway in each of Japan’s five biggest trading houses.

Mitsubishi Corp gained 3.12%, Mitsui & Co rose 1.99%, and Sumitomo Corp added 1.86%. Marubeni and Itochu Corp rose 1.22% and 1.41%, respectively.

Broader investor sentiment received some boost from data showing factory activity in China expanded at the fastest clip in nearly a decade in August, bolstered by the first increase in new export orders this year.

· China stocks close higher on strong factory PMI data

China stocks closed higher on Tuesday, led by new energy vehicle-related and mining shares, as strong factory data reflecting a bounce-back in its economy from the coronavirus crisis lifted sentiment.

The Shanghai Composite index ended 0.44% higher at 3,410.61.

The blue-chip CSI300 index was up 0.54%, with financial sector sub-index gaining 0.08%, the consumer staples sector rising 0.21%, the real estate index falling 0.25% and the healthcare sub-index sliding 0.36%.

China’s factory activity expanded at the fastest clip in nearly a decade in August, bolstered by the first increase in new export orders this year, the Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) showed.

· European markets start the month on a positive note

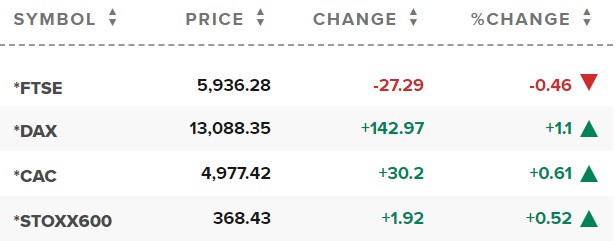

European markets opened higher on Tuesday after the latest data from China showed manufacturing activity in the world’s second-largest economy expanded at its fastest rate in nearly 10 years.

The pan-European Stoxx 600 index rose over 0.6% higher in early morning deals, with most sectors and major bourses in positive territory. Technology shares led the gains with a 1.6% jump. Among bourses, London’s FTSE 100 slipped 0.2% into negative territory.

Reference: CNBC, Reuters, FXEmpire