· Global stocks firm, shrug off tech rout scare and Sino-U.S. tensions

Asian shares gained on Tuesday following a small bounce in European markets and shrugging off concerns over the latest U.S.-China tensions, as investors looked to whether high-flying U.S. tech shares could recover from their recent rout.

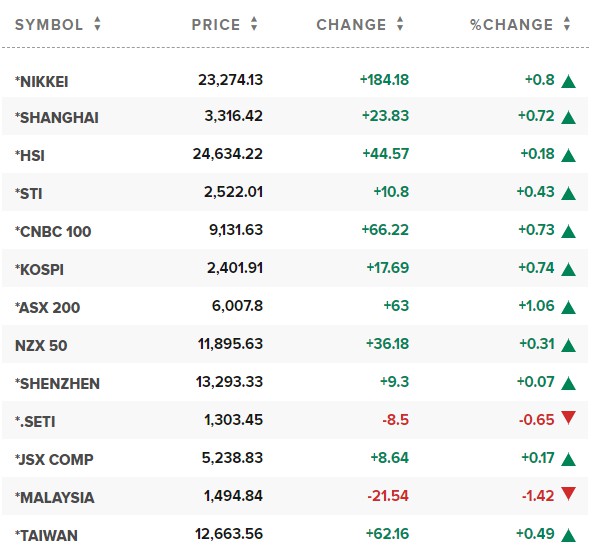

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.4%. Japan's Nikkei .N225 added 0.8%, even as revised data confirmed the nation had slumped into its worst postwar contraction, with business spending taking a bigger hit from the coronavirus pandemic than initially estimated.

Shares in mainland China and Hong Kong managed to erase early losses made after President Donald Trump on Monday ramped up his anti-Chinese rhetoric by again raising the idea of de-coupling the U.S. and Chinese economies.

· Japan stocks rise on recovery hopes, SoftBank falls again

Japanese stocks rose on Tuesday for the first time in three sessions, as investors focused on COVID-19 vaccine developments and held on to hopes that global economic growth will continue to recover from the coronavirus crisis.

Conglomerate SoftBank Group, however, extended falls to hit a two-month low. It settled down 0.61%, adding to the previous session's hefty 7.2% decline as the company bought large amounts of call options on U.S. technology stocks.

The company has spent billions of dollars buying shares in technology companies such as Amazon and has also made significant options purchases in tech companies, sources familiar with the matter told Reuters.

Traders said they now wanted to see whether U.S. tech shares recover from the last week's rout.

The Nikkei 225 Index ended 0.8% higher at 23,274.13, with consumer discretionary and consumer staples shares leading the gains. The broader Topix rose 0.69%.

Japanese shares were also buoyed by gains in U.S. stock futures during Asian trading. U.S. financial markets were closed on Monday for the Labor Day holiday.

The Japanese government approved on Tuesday spending from emergency budget reserves to secure coronavirus vaccines, which supported investor sentiment.

· China stocks end higher as financials lend support

China stocks closed higher on Tuesday, supported by heavyweight financials firms as investors sought opportunities in cheap shares, though persistent Sino-U.S. tensions weighed on the market.

The blue-chip CSI300 index rose 0.5%, to 4,694.39, while the Shanghai Composite Index added 0.7% to 3,316.42, snapping a four-day losing streak.

· European stocks retreat as tech continues to struggle; Royal Mail up 15%

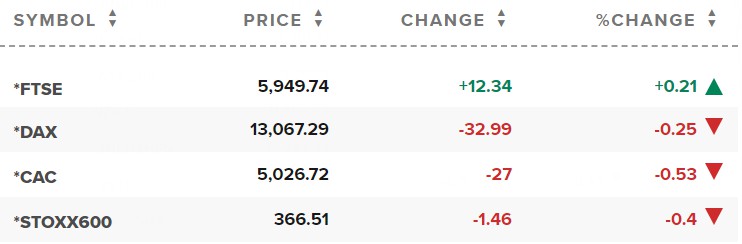

European markets made a choppy start Tuesday as global investors waited to see whether the dominant U.S. tech sector can recover momentum after last week’s rout, while awaiting key economic data due out of the euro zone.

The pan-European Stoxx 600 slid 0.4% below the flatline in early trade, with the tech sector falling another 1.6% while telecoms eked out 0.5% gains.

In terms of individual share price action, Royal Mail surged 15% to lead the Stoxx 600 in early trade after the British postal company raised its revenue target. At the other end of the European blue-chip index, builders’ merchant Travis Perkins fell 7.4% after reporting a steep decline in profits in the second quarter, while French utility EDF fell 6.5% after reporting a 17.6% fall in output in August.

Reference: CNBC, Reuters