· Stocks rally but lacklustre without fresh stimulus

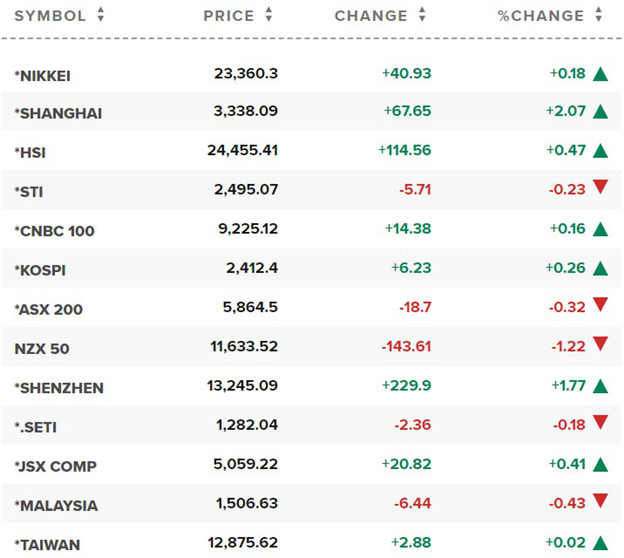

Asian stocks inched up on Friday but lingering disappointment that central banks merely affirmed their monetary support this week, while not promising new stimulus, kept a lid on gains.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.4% to head for its first weekly gain in three weeks.

· Nikkei ticks up; Suga's policy boosts software firms, hits telecoms

Japanese shares inched higher on Friday, helped by broad optimism surrounding Prime Minister Yoshihide Suga’s policies, but expensive valuations and a murky earnings outlook made investors cautious ahead of a long weekend.

Nikkei share average rose 0.18% to 23,360.30 and the broader Topix 0.49% to 1,646.42, with turnover hitting the highest level in three weeks.

System integration and software companies jumped after Nikkei business daily reported that Suga will work to get his flagship new digital technology agency running by autumn 2021.

Telecom shares came under fresh pressure after Suga instructed a minister to consider lowering cell phone charges, one of his long-time policy focus.

· China stocks post weekly gain on stimulus hopes, yuan strength

China stocks staged a strong finish on Friday, led by heavyweight financials on hopes of fresh supportive measures to boost the virus-ravaged economy, while a strong yuan also helped lure foreign inflows.

The blue-chip CSI300 index ended up 2.3% at 4,737.09, while the Shanghai Composite Index rose 2.1% to 3,338.09.

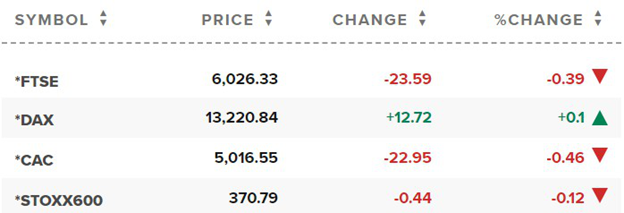

· European markets mixed with coronavirus spike, U.S. tech in focus

European stocks were mixed Friday morning as investors monitored a rise in coronavirus cases across the continent and the prospects of economic recovery, along with further declines for U.S. tech giants.

The pan-European Stoxx 600 hovered 0.1% below the flatline in early trade, with travel and leisure stocks dropping 1.3% to lead losses while basic resources added 1%.

Reference: CNBC, Reuters