· S&P 500 Futures bounce off seven week low toward 3,350 amid risk reset

S&P 500 Futures prints 0.20% gains while rising to 3,325 during Monday’s Asian session. Although the absence of traders from Tokyo and a light calendar trigger risk reset, news from Wellington and Beijing favor the risk-tone sentiment. In doing so, fears of the coronavirus (COVID-19) and the Tehran-Washington tussle seem to have been ignored, for now.

After a few weeks of the second lockdown, New Zealand’s (NZ) Prime Minister Jacinda Ardern announced an easing of virus-led restrictions to alert level 1 outside the epicenter Auckland. On the other hand, China’s President Xi Jinping praised the economic momentum while shrugging off geopolitical risks, indirectly hitting the US.

Alternatively, the recent surge in the UK’s pandemic numbers joins escalating new cases from Europe to renew fears of another lockdown conditions. Also challenging the risk could be the US threat to levy sanctions on over 20 firms tied to helping Iran over arms’ building.

Elsewhere, China’s Global Times again flashed war signals, this time for Australia, while saying, "If we have no choice but war, we should first avoid direct conflict with the US. We can (instead) severely beat up a US running dog that always crosses our bottom line... to send a warning.”

It should also be noted that the global markets are still hopeful of further stimulus from the UK, Japan and the US, which in turn should favor the equities. Though, tech rout and aid-package deadlock in America seems to weigh on the shares amid the mixed signals from the US Federal Reserve.

Moving on, Chicago Fed National Activity Index and Fed Chair Jerome Powell’s speech will be the key to watch for fresh impetus. However, risk catalysts will remain in the driver’s seat.

· HSBC and StanChart shares tumble after reports show they moved suspicious funds; Asia-Pacific markets mostly lower

Hong Kong-listed shares of Standard Chartered and HSBC tumbled on Monday following reports that they allegedly moved large sums of suspicious funds.

By Monday afternoon, shares of Standard Chartered tumbled 2.69% and HSBC fell 2.91%. Earlier in the trading day, shares of HSBC had fallen to a more than 25-year low, according to FactSet. The moves came after the banks — among several global lenders — were identified in media reports as having allegedly moved suspicious funds over a period of nearly two decades, according to Reuters. The reports cited confidential documents submitted by banks to the U.S. government.

“We do not comment on suspicious activity reporting,” HSBC said in a statement to CNBC.

Standard Chartered, meanwhile, said in a statement: “The reality is that there will always be attempts to launder money and evade sanctions; the responsibility of banks is to build effective screening and monitoring programmes to protect the global financial system.”

“We take our responsibility to fight financial crime extremely seriously and have invested substantially in our compliance programmes,” Standard Chartered wrote.

· Asian shares cling to tight ranges as attention shifts to U.S. election, stimulus

Asian shares and most currencies held tight ranges on Monday, as investors awaited developments on U.S. fiscal stimulus and coronavirus vaccines amid a resurgence of infections in Europe.

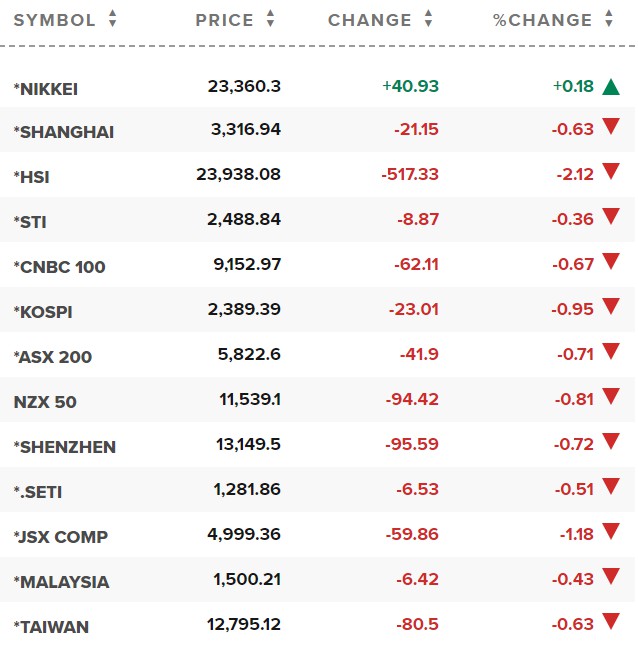

MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.1% weaker, though it was not too far from a June 2018 peak at 568.84.

Japanese markets were closed for a public holiday.

Coronavirus cases have now surpassed 30 million, casting a gloomy pall over prospects of a V-shaped economic recovery.

· China shares end lower as key lending rate kept steady for 5th month

China stocks ended lower on Monday, dragged by consumer staples and financial stocks after the central bank left its benchmark lending rate unchanged, with investors taking profits after expectations of further stimulus lifted shares in the previous session.

At the close, the Shanghai Composite index was down 0.63% at 3,316.94.

The blue-chip CSI300 index shed 0.96%, with its financial sector sub-index falling 0.95% and the consumer staples sector down 1.61%. Both sub-indexes had posted strong gains on Friday.

· European stocks fall as bank allegations, coronavirus weigh on sentiment; banks down 4.5%

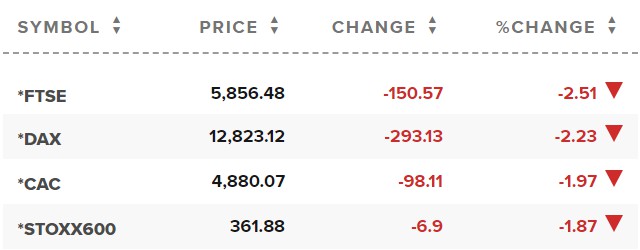

European stocks retreated Monday as allegations surrounding bank dealings and rising coronavirus infections weigh on market sentiment around the world.

The pan-European Stoxx 600 dropped 2% in early trade, with banks plummeting 4.5% to lead losses as all sectors and major bourses slid into negative territory.

In Asia, Hong Kong-listed shares of Standard Chartered and HSBC tumbled on Monday following reports that they allegedly moved large sums of suspicious funds. By Monday afternoon, shares of Standard Chartered tumbled 2.69% and HSBC fell 2.91%. Earlier in the trading day, shares of HSBC had fallen to a more than 25-year low, according to FactSet.

Reference: Reuters, CNBC, FXStreet