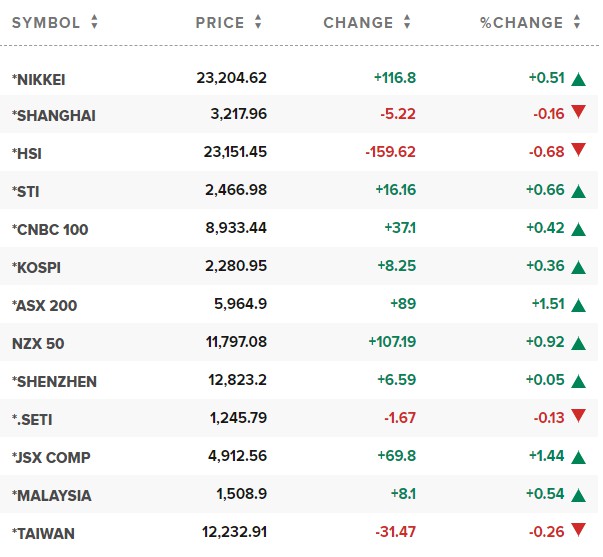

· Asian shares make tepid recovery on tech rally and stimulus hopes

Asian shares rose on Friday after robust U.S. housing data supported a late tech-driven rally on Wall Street, with investors picking up the pieces a day after a broad regional index posted its biggest daily loss in more than three months.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was 0.4% higher, after slumping 2.15% a day earlier, its biggest daily drop since June 11.

· Japan shares end higher as traders await more U.S. stimulus

Japanese stocks rose on Friday, tracking tech-led strength on Wall Street overnight as hopes for more U.S. stimulus offset some concerns about the health of the global economy.

The Nikkei 225 Index ended 0.51% higher at 23,204.62. The broader Topix gained 0.48% to 1,634.23.

For the week, however, the benchmark fell 0.67%, as some analysts warned that worries about a second wave of coronavirus cases in Europe could limit further upside for Japanese shares.

Supporting sentiment on the day, a top U.S. lawmaker said Democrats in the House of Representatives were working on a $2.2 trillion coronavirus stimulus package that could be voted on next week.

· China stocks end flat, post worst weekly fall in over 2 months on virus worries

China’s major indexes ended little changed on Friday, but posted their worst weekly decline since mid-July as a resurgence in COVID-19 cases globally raised concerns about the pace of economic recovery.

The blue-chip CSI300 index rose 0.2%, to 4,570.02, while the Shanghai Composite Index slipped 0.1%to 3,219.42.

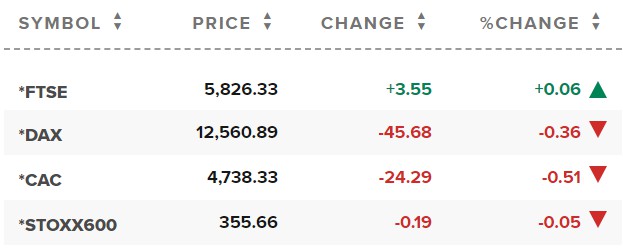

· European stocks open mixed as investors monitor economic recovery, coronavirus

European stocks opened mixed Friday as investors continue to monitor coronavirus developments and the prospects of economic recovery.

The pan-European Stoxx 600 hovered just below the flatline at the start of trading, with basic resources adding 0.5% while tech stocks fell 0.6%.

Reference: Reuters, CNBC