· U.S. stock futures higher as Wall Street looks to recover from Tuesday tumble

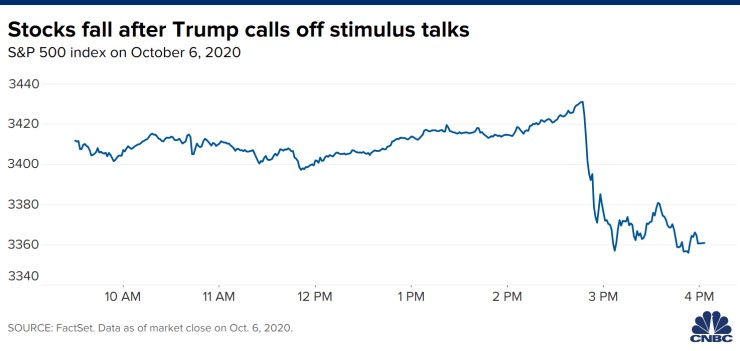

U.S. stock futures were higher in early morning trading on Wednesday following a Tuesday slip after President Donald Trump called off stimulus talks until after the November election.

Dow futures were up 126 points. S&P 500 futures and Nasdaq 100 futures traded in positive territory.

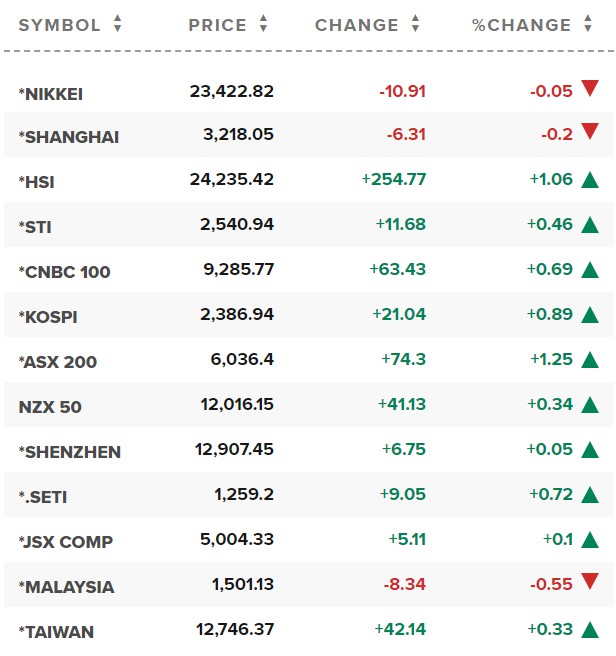

Asia shares mount late recovery as Trump deals stimulus blow

Japan stocks lower at close of trade; Nikkei 225 down 0.05% as losses in the Paper & Pulp, Railway & Bus and Real Estate sectors led shares lower.

Philippines and Indonesian shares dropped

on Wednesday after the mood on global stock markets was dented

by U.S. President Donald Trump's decision to end talks about a

U.S. stimulus package, although late gains helped turn other

Asian markets positive.

Shares in Manila fell close to 1%, extending losses

from Tuesday when data showed September inflation slowing to a

four-month low. The Philippine index underperformed its

neighbours in Jakarta and Kuala Lumpur.

The numbers raised further questions about the Philippines'

economic recovery, with parts of the country still under

COVID-19 restrictions and the central bank suggesting it will

hold rates so prior cuts can filter through.

* "I do not believe hopes of a stimulus deal are now gone

forever," said Jeffrey Halley, a senior Asia market analyst at

OANDA.

"Asian markets will likely spend the day digesting the

implications of a no U.S. stimulus agreement."

* Trump trails Democrat Joe Biden in most polls and if his

rival sweeps the election, Democrats are likely to push ahead

with a package. Markets in Asia are also eyeing whether a Biden

presidency would ease tense relations with China - the region's

main engine of growth.

* Chinese markets will reopen after a week-long holiday on

Friday.

· Asia-Pacific is set to outperform other markets in the next six months, says Nikko Asset Management

As uncertainty clouds equity markets ahead of the upcoming U.S. presidential election, one asset management firm is placing its bets on Asia-Pacific.

“For the most part, yes, we’re quite happy to have risk positions on in Asia-Pacific,” John Vail, chief global strategist at Nikko Asset Management, told CNBC’s “Street Signs Asia” on Tuesday. He said his firm expects “all of Asia-Pacific to outperform in the six months ahead period.”

“We’re not afraid, especially for long-term investors, to have to put positions on now in Asia-Pacific,” Vail said.

MSCI’s broadest index of Asia-Pacific shares outside Japan crept 0.4% higher to a fresh two-week peak, led by a 1.3% gain in Australia where an expansionary budget lifted stocks.

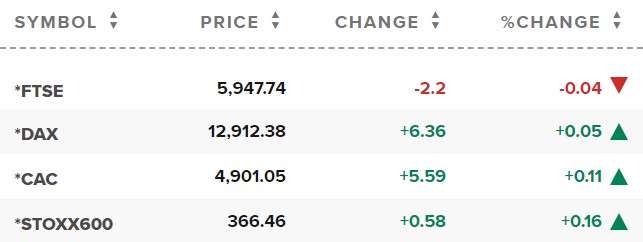

· European markets mixed as earnings weigh off against U.S. stimulus fears

European stocks were mixed on Wednesday morning as investors digested a robust round of earnings and President Trump’s decision to halt stimulus talks until after the November election.

The pan-European Stoxx 600 hovered just above the flatline in early trade, with utilities adding 1.1% while insurance stocks fell 1.1%.

Markets in the U.S. and Asia-Pacific have been reacting Trump’s tweet on Tuesday that the White House is halting talks with Democrats about a second coronavirus stimulus deal.

Reference: Reuters, CNBC, Investing