· JPMorgan says investors should look past U.S. election ‘noise’ and focus on medium term

With uncertainty looming over the upcoming U.S. elections in November, JPMorgan Asset Management’s Patrik Schowitz says investors should look past the “noise” and focus on the medium term instead.

“On a six month view, you know, we think the cyclical view matters much, much more than … the exact noise and shenanigans around the U.S. election,” Schowitz, global multi-asset strategist at the firm, told CNBC’s “Street Signs Asia” on Wednesday.

“Anything longer than say two or three months, you should be positioned risk-on, you should be overweight risky assets like credit, like equities,” he said.

Still, Schowitz acknowledged that there are “a lot of risks” ahead over the next month or two, with the firm staying more balanced at present.

“We’ve reduced risk, reduced the size of positioning across our portfolio somewhat but we haven’t really changed the direction,” the strategist said.

“The direction for us is still dominated by the fact that we are through the recession, we are into the next economic cycle — the general direction for markets and economies should be upwards,” he added. “Where a lot of this noise comes in is that it is hard to take a very clear bet in terms of cyclical, defensive, value, growth.”

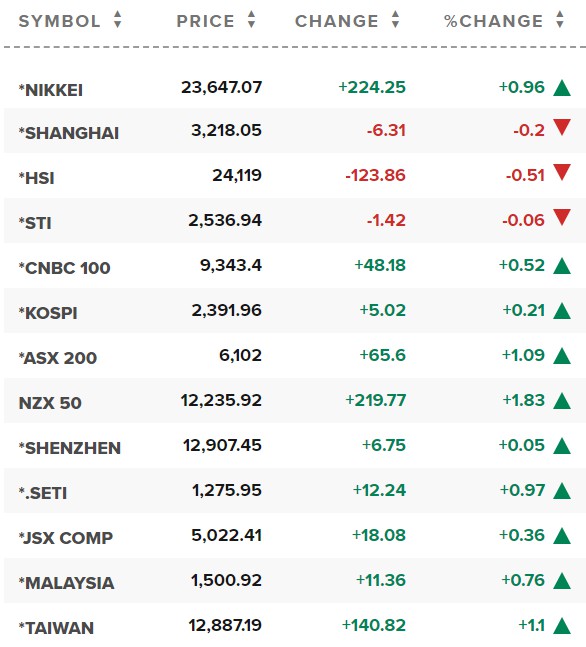

· Asia-Pacific shares mostly higher; SMIC shares in Hong Kong slide

Stocks in Asia-Pacific were mostly higher in Thursday trade, with shares in Hong Kong lagging among the region’s major markets.

In Japan, the Nikkei 225 gained 0.96% to close at 23,647.07 while the Topix index advanced 0.55% to end its trading day at 1,655.47.

South Korea’s Kospi rose 0.21% on the day to 2,391.96. Shares of industry heavyweight Samsung Electronics dipped 0.33%. The firm announced earlier its profit for the three months that ended in September likely rose 58% from a year ago.

Stocks in Australia also saw gains, with the S&P/ASX 200 up 1.09% to close at 6,102.

Hong Kong’s Hang Seng index lagged among the region’s major markets, slipping 0.36%, as of its final hour of trading.

MSCI’s broadest index of Asia-Pacific shares outside Japan added 0.62%.

SMIC shares in Hong Kong slide

Hong Kong-listed shares of SMIC fell 1.37% in afternoon trade after S&P Global Ratings placed the chipmaker on a negative credit watch. SMIC currently has a long-term issuer credit rating of “BBB-,” according to S&P Global Ratings.

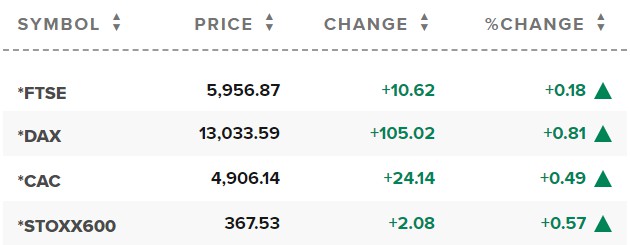

· European markets open higher as investors keep an eye on U.S. stimulus talks

European stocks opened higher Thursday with global investors keeping an eye on ongoing stimulus discussions in the U.S.

The pan-European Stoxx 600 climbed 0.7% in early trade, with travel and leisure stocks jumping 2.2% to lead the way as almost all sectors and major bourses entered positive territory.

The positive trend in European markets comes as U.S. stock index futures were modestly higher in Thursday early morning trading. This comes after the Dow on Wednesday posted its best day in months as investors await updates on the ongoing fiscal stimulus discussions.

The major averages rose sharply on Wednesday after President Donald Trump tweeted support for aid to airlines and other stimulus measures, stoking hopes that a smaller aid package could be passed by lawmakers.

Reference: Reuters, CNBC