· Dollar, yen sold as U.S. stimulus hopes boost sentiment

The safe-haven dollar and yen nursed losses on Thursday, after the revival of hopes for some U.S. spending improved investor sentiment and appetite for riskier currencies.

A flurry of late-Tuesday tweets from President Donald Trump, after he cancelled talks with Democrats over coronavirus relief, suggested he was open to piecemeal spending measures.

That lifted equity markets and commodity currencies and sank the safe-haven yen to a three-week low of 106.11 per dollar overnight. The dollar was weaker on most other majors.

The euro edged up 0.2% to $1.1767 and held there early in the Asia session. The risk-sensitive Australian dollar lifted off a one-week low and rose about 0.5% overnight to hold at $0.7137 in Asia.

· US Initial Jobless Claims Preview: Unemployment filing and payrolls reverse in September

New requests for unemployment insurance in the US are subsiding at a glacial pace that saw more claims filed each week in September than Nonfarm Payrolls added in the entire month.

Payrolls rose 661,000 last month but in the latest week of October 2 the four week average for initial claims was 867,250. That is the first month since the recovery began in May that the weekly unemployment average has topped the monthly payrolls.

· White House aides downplay coronavirus aid chances; Pelosi blasts Trump, but discusses airline help

Top White House officials on Wednesday downplayed the possibility of more coronavirus relief, while House Speaker Nancy Pelosi disparaged President Donald Trump for backing away from talks on a comprehensive deal.

White House Chief of Staff Mark Meadows told reporters that “the stimulus negotiations are off,” echoing Trump’s announcement on Tuesday, and said in an interview on Fox News the administration backed a more piecemeal approach to help some sectors of the economy.

But in a separate interview with CNBC, White House economic adviser Larry Kudlow said that approach would likely not work either.

“Right now in terms of the probability curve, this would probably be low low-probability stuff.”

· Business, labor groups urge G20 to close 'stimulus gap' in COVID-19 crisis

The Group of 20 nations must offer poorer countries a longer freeze in debt payments and other help to protect the global economy from long-term scarring inflicted by the COVID-19 pandemic, leading business and labor groups said.

Warning of job losses, increasing poverty, rising child mortality and high business failure rates in poorer countries, the groups urged G20 finance ministers, who will meet by teleconference next week, to take immediate action.

· BOJ's Kuroda says economy to continue recovering from pandemic's pain

Bank of Japan Governor Haruhiko Kuroda said on Thursday the economy was starting to pick up and was likely to continue recovering thanks in part to the boost from fiscal and monetary stimulus measures.

While consumer prices will fall for the time being due to the impact of slumping oil prices, they are likely to rebound thereafter as the pandemic’s fallout on the economy eases, he said.

“Once the impact of the coronavirus pandemic subsides globally, Japan’s economy is likely to continue improving further as overseas economies resume steady growth,” Kuroda said in a speech to a quarterly meeting of the BOJ’s branch managers.

· Japan's service sentiment hits two-and-a-half-year high, bankruptcies fall

Japan’s service sector sentiment rose in September to the highest level in 2-1/2 years, government data showed on Thursday, suggesting that the economy is gradually recovering from the devastating impact of the coronavirus pandemic.

· Oil prices edge up as Hurricane Delta approaches U.S. Gulf of Mexico

Oil prices inched up on Thursday as oil workers evacuated rigs in the U.S. Gulf of Mexico ahead of Hurricane Delta, though fuel demand concerns persisted on fading chances for a U.S. economic stimulus deal and a build in U.S. crude inventories.

U.S. West Texas Intermediate (WTI) crude futures rose 3 cents, or 0.1%, to $39.98 a barrel at 0435 GMT, after falling 1.8% on Wednesday.

Brent crude futures rose 9 cents, or 0.2%, to $42.08 a barrel, after falling 1.6% on Wednesday.

· U.S. oil-export projects stall as output slips, opposition builds

The coronavirus pandemic has stalled a once-furious race among energy companies to build deepwater oil export terminals off the Texas coast, amid permitting delays and rising environmental opposition.

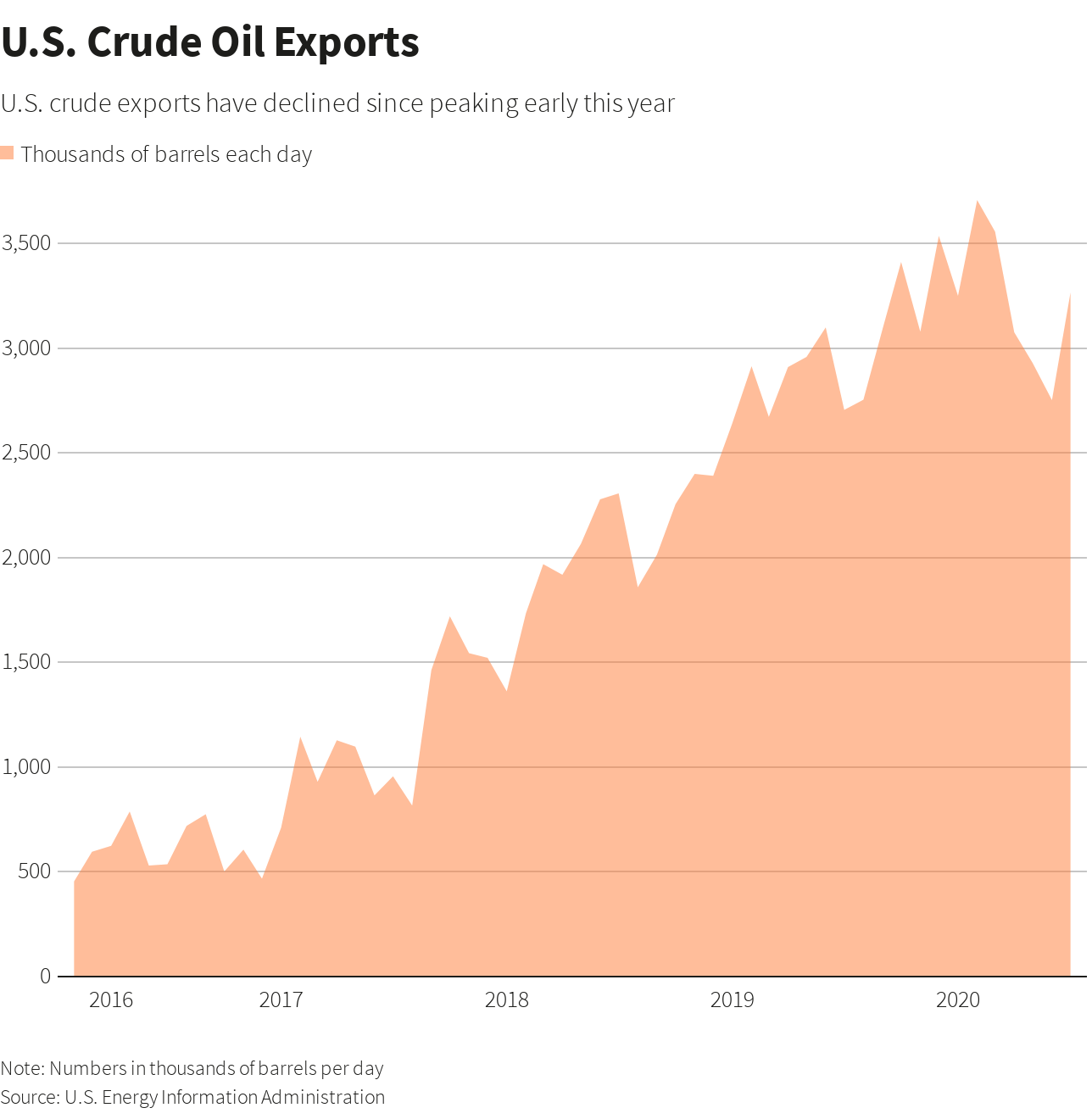

U.S. oil production has declined 18% and crude prices CLC1 have tumbled 35% this year, lessening demand for new export ports. Daily U.S. crude exports slowed to 8% gain through July, down from 46% last year, according to U.S. data.

· U.S. expected to impose new sanctions on Iran's financial sector – source

· U.S. warns China against Taiwan attack, stresses U.S. 'ambiguity'

The U.S. national security adviser warned China on Wednesday against any attempt to take Taiwan by force, saying amphibious landings were notoriously difficult and there was a lot of ambiguity about how the United States would respond.

Reference: CNBC, FXStreet, Reuters