· Global shares advance on stimulus, Biden victory hopes

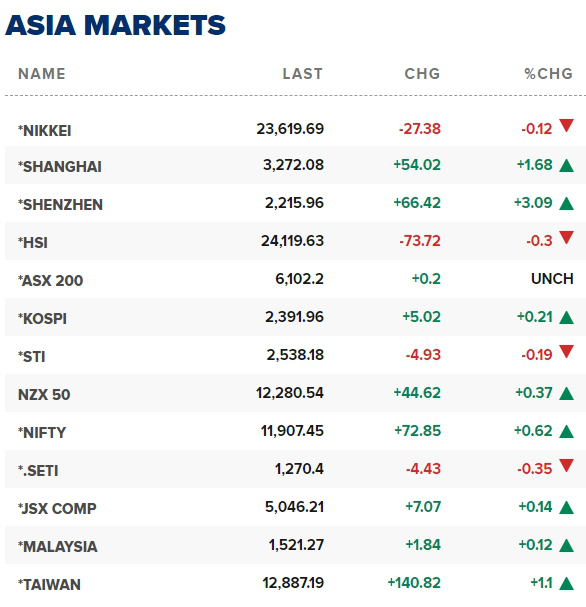

Asian shares inched towards 2-1/2-year highs on Friday as revived hopes for a U.S. stimulus deal eclipsed weaker-than-expected jobs data, while mainland Chinese markets jumped after a week-long holiday.

Investors were also increasingly expecting the Democrats to take back the White House, and possibly the Senate as well, in the Nov. 3 U.S. election, analysts said.

The Shanghai composite jumped 1.89% while the Shenzhen component gained 3.195% by the afternoon.

The moves came as a private survey showed services sector activity in China expanding in September. The Caixin/Markit services Purchasing Managers’ Index for September came in at 54.8. PMI readings above 50 signify expansion, while those below that level indicate contraction.

Data out of China has been watched for clues on the state of the country’s economic recovery from the coronavirus pandemic.

Over in Hong Kong, the Hang Seng index was fractionally higher. Shares of biopharmaceutical startup Everest Medicines jumped more than 35% from their issue price by the afternoon in their market debut day in the city.

In Japan, the Nikkei 225 dipped 0.32% while the Topix index was 0.59% lower.

Meanwhile, shares in Australia advanced, with the S&P/ASX 200 up 0.15%.

MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.36%.

Markets in South Korea and Taiwan are closed on Friday for holidays.

Investor focus was also likely be on ongoing developments regarding potential new fiscal stimulus stateside. House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin spoke on Thursday about a broad coronavirus stimulus plan, after U.S. President Donald Trump pulled out of talks earlier in the week and called for stand-alone bills.

· Nasdaq-listed Chinese video platform Bilibili to do a secondary listing in Hong Kong, raise up to $1.5 billion

· European stocks rise on upbeat forecasts from Pandora, Novo Nordisk

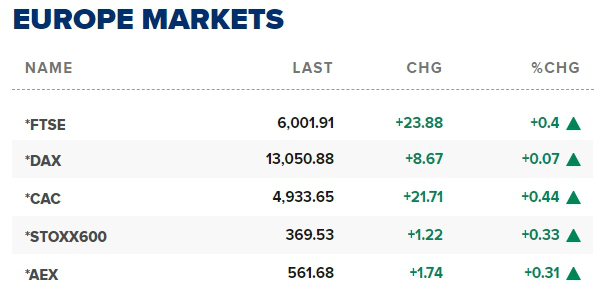

European stock markets gained on Friday on rosy earnings forecasts from retailers Pandora and Zalando as well as drugmaker Novo Nordisk, with investors keeping an eye out for signs of fresh U.S. stimulus.

Danish jewellery maker Pandora PNDORA.CO jumped 10.6% and German online fashion company Zalando ZALG.DE rose 3.7% after raising their outlook for 2020 on the back of a strong third quarter.

Danish pharma company Novo Nordisk NOVOb.CO gained 3.2% after it raised its 2020 sales and operating outlook.

The broader STOXX 600 index .STOXX rose 0.4% by 0713 GMT, led by miners .SXPP and oil companies .SXEP as commodity prices rose. The index was on course to record its second straight week of gains. [MET/L] [O/R]

U.S. President Donald Trump said in an interview with Fox News that talks with Congress have restarted over further COVID-19 relief and that there was a good chance a deal could be reached. But he gave no other details about a possible agreement.

Reference: Reuters, CNBC