· CEO of world’s biggest money manager sees ‘more to go on the upside’ for the stock market

BlackRock Chairman and CEO Larry Fink told CNBC on Tuesday the stock market can continue to move higher, adding to the strong rebound in recent months after the coronavirus-driven sell-off earlier this year.

Fink also said the prevalence of low Federal Reserve interest rates for longer while the U.S. economy tries to dig out of the pandemic-induced hole will help stocks. Additionally, he expressed optimism that another fiscal stimulus package to support the recovery will eventually be approved, even if it doesn’t end up happening until early next year after the presidential election.

Another factor likely supporting continued strength in the stock market is the influx of more active individual investors, Fink said.

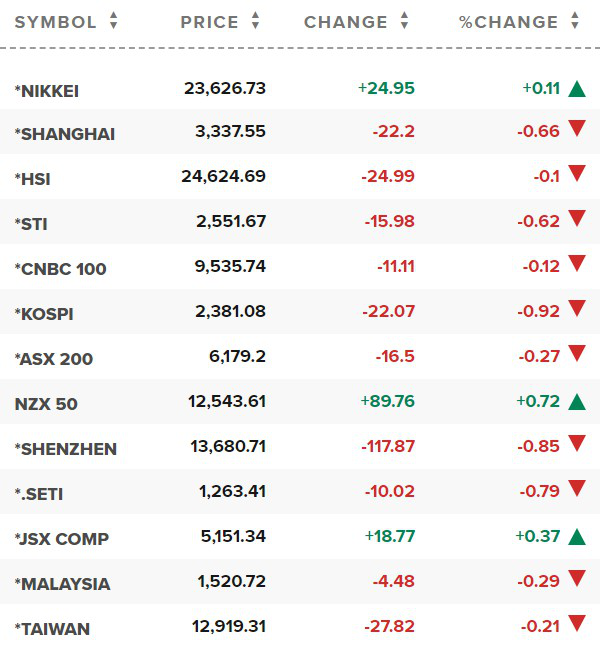

· Asian equities toppled by stalled vaccine trials, stimulus talks

A gauge of Asian shares was knocked off a 2-1/2-year peak on Wednesday, as halted COVID-19 vaccine trials and an impasse in U.S. stimulus talks soured risk appetite, while oil was hit by demand concerns amid growing coronavirus cases.

MSCI's broadest index of Asia-Pacific shares outside of Japan .MIAPJ0000PUS tracked Wall Street's losses to end a seven-day rally.

· Nikkei recoups losses but stalled vaccine trials, stimulus talks weigh

Japan's stock benchmark Nikkei recouped early losses on Wednesday to close marginally higher, but sentiment remained subdued over stalled COVID-19 vaccine trials and lack of agreement on additional U.S. fiscal stimulus.

The benchmark Nikkei share average <.N225> rose 0.11% to 23,626.73, while the broader Topix <.TOPX> lost 0.32% to 1,643.90.

Tokyo shares followed Wall Street lower in early trade before reversing course in the afternoon, which analysts suspected was due to the Bank of Japan's exchange-traded fund buying.

On Tuesday, major indexes on Wall Street ended lower as Johnson & Johnson <JNJ.N> and Eli Lilly and Co <LLY.N> halted coronavirus vaccine and antibody treatment trials, respectively, over safety concerns, dampening investor sentiment.

· China stocks end lower on property sector woes, profit-taking

China shares ended lower on Wednesday, with property firms among the biggest laggards, on mounting pressure for raising cash under the government’s new debt-ratio caps, while profit-taking in agricultural stocks after recent sharp gains also weighed.

At the close, the Shanghai Composite index was down 0.56% at 3,340.78. ** The blue-chip CSI300 index was down 0.66%, with its real estate index down 1.21% and the healthcare sub-index down 0.61%.

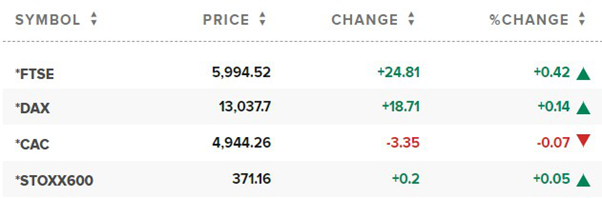

· European shares slip on caution around vaccine trials, stimulus

European shares headed lower on Wednesday after tumbling in the previous session over a halt in COVID-19 vaccine trials and uncertainty over more U.S. stimulus, with investors also staying away from big bets ahead of talks on a Brexit trade deal.

The pan-European STOXX 600 .STOXX was down 0.2% by 0708 GMT, with travel and leisure .SXTP and insurance .SXIP stocks leading early declines.

Reference: Reuters, CNBC