· Stocks making the biggest moves after hours: United Airlines, Fastly & more

United Airlines — Shares of United Airlines fell more than 1% after the company reported a bigger-than-expected loss for the third quarter.

Alcoa — Alcoa shares dipped 4.2% even after the aluminum company posted better-than-expected third-quarter results. Alcoa reported a loss of $1.17 per share on revenue of $2.37 billion.

Sleep Number — Sleep Number shares rallied more than 8% in after-hours trading on the back of stronger-than-forecast quarterly results.

Fastly — Fastly plunged 28% after the cloud company reported disappointing preliminary results. The company said it expects third-quarter revenue to range between $70 million and $71 million.

Fastly had previously forecast sales ranging between $73.5 million and $75.5 million.

· Dow futures fall more than 100 points as Wall Street struggles to bounce from 2-day slide

U.S. stock futures were lower early Thursday morning as traders continued to weigh the prospects for a coronavirus aid deal being reached before next month’s election.

Dow Jones Industrial Average futures were down 164 points. S&P 500 futures and Nasdaq 100 futures also traded in negative territory.

· Shares retreat on coronavirus resurgence, fading U.S. stimulus hopes

Global shares slipped on Thursday as investors locked in recent gains amid rising concerns about resurgent COVID-19 infections and after the U.S. Treasury Secretary dashed any remaining hopes of a stimulus package before the Nov. 3 election.

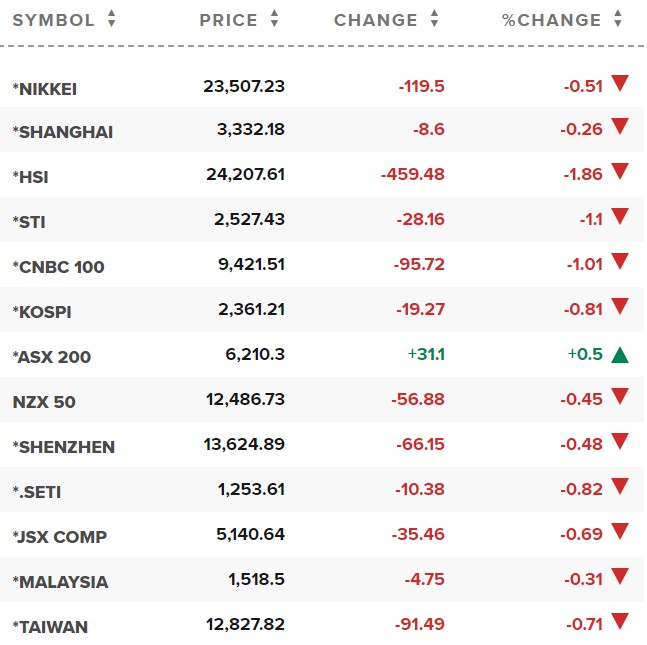

European shares were set to open lower, with the pan-European Euro Stoxx50 futures STXEc1 falling 0.7%. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS lost 0.6% while Japan's Nikkei .N225 dropped 0.5%.

Concerns that a resurgence in the COVID-19 pandemic could lead governments to again shut down economies spurred profit-taking.

With COVID-19 cases surging, some European nations are closing schools, cancelling surgery and enlisting student medics as overwhelmed authorities braced for a repeat of the nightmare scenario seen earlier this year.

· Japan stocks fall as risks on several fronts unsettle investors

Japanese stocks fell on Thursday as fading hopes for a new round of U.S. fiscal stimulus, a return of coronavirus lockdowns in Europe and worries about Sino-U.S. tensions hurt sentiment.

The Nikkei index ended 0.51% lower at 23,507.23, with the healthcare and telecommunications sectors leading the decline. The broader Topix fell 0.74% to 1,631.79.

U.S. Treasury Secretary Steve Mnuchin said reaching a compromise with the Democrats on a fiscal stimulus was unlikely before the Nov. 3 election, raising concerns about the economic outlook for an economy reeling from the impact of the COVID-19 pandemic.

Sentiment also worsened after sources told Reuters the U.S. State Department has submitted a proposal for President Donald Trump administration to add China’s Ant Group to a trade blacklist, which could complicate its highly-anticipated initial public offering.

Britain has introduced a new lockdown system, France imposed curfews and other European nations were closing schools to stop a second wave of the novel coronavirus.

· China shares end lower; industrials drag on weak Sept inflation

China shares ended lower on Thursday, erasing earlier gains after data showing falling factory gate prices and weak consumer inflation in September underscored persistent challenges facing the economy as it recovers from the COVID-19 pandemic.

At the close, the Shanghai Composite index was down 0.26% at 3,332.18. The blue-chip CSI300 index fell 0.17%.

Industrial firms weighed on the broader index, falling 0.92% after factory gate prices fell at a faster-than-expected pace in September and consumer inflation slowed

toits weakest in 19 months, indicating continued challenges facing the Chinese economy.

Adding to concerns over Sino-U.S. tensions, Reuters reported that the Trump administration is considering adding China’s Ant Group to a trade blacklist before its high-profile dual listing in Shanghai and Hong Kong.

· European markets tumble as stimulus hopes fade and coronavirus surges

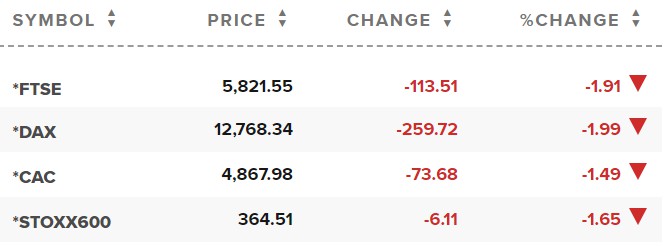

European stocks opened sharply lower Thursday as hopes fade that a U.S. stimulus package will be agreed before the November election, and as restrictions return across Europe due to a surge in coronavirus infections.

The pan-European Stoxx 600 dropped 1.7% at the start of trading with travel and leisure stocks plunging 2.9% to lead losses, as all sectors and major bourses slid into negative territory.

Reference: Reuters, CNBC