* Kansas City Fed Bank President Esther George said the Fed should push ahead with interest rate hikes because of the strong fundamentals of the U.S. economy.

- The yen and euro held on to overnight gains against the dollar on Wednesday after a sharp slide in crude oil prices fuelled risk aversion, driving down U.S. debt yields to 9-month lows and dulling the greenback's appeal.

The euro was steady at $1.0924 EUR= following an overnight gain of 0.3 percent. The dollar was little changed at 119.83 yen JPY= after shedding 0.9 percent overnight.

The U.S. currency had surged to a 6-week high of 121.70 yen on Friday after the Bank of Japan stunned the markets by adopting a negative interest rate policy.

But oil prices have since resumed declining, shaking equity markets and bringing investors' focus back to global growth woes and central bank policies.

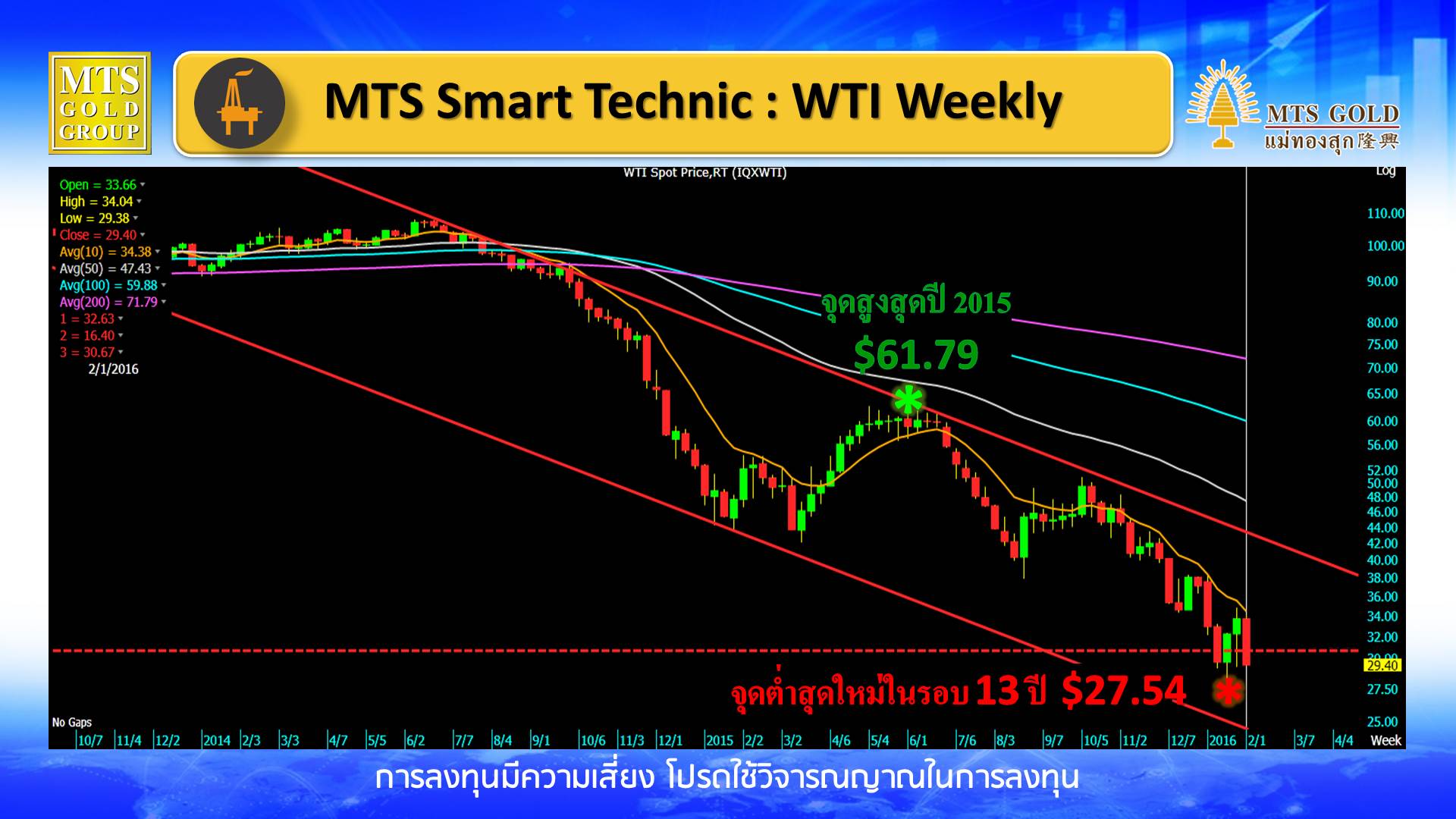

- U.S. oil futures extended losses into a third session in early Asian trade on Wednesday as U.S. crude stocks last week surged to more than half a billion barrels, stoking concern over global oversupply.

Milder weather forecast for the last eight weeks of the U.S. November-March winter heating season has further dampened demand hopes.

The front month contract for West Texas Intermediate (WTI) CLc1 was down 40 cents at $29.48 at 0035GMT, after settling down $1.74, or 5.5 percent, in the previous session.

That came as U.S. crude stocks rose by 3.8 million barrels to 500.4 million in the week to Jan. 29, data from industry group, the American Petroleum Institute showed on Tuesday. And crude stocks at the Cushing, Oklahoma, delivery hub rose by 141,000 barrels, the API said.

The increase led to renewed fears of overflowing oil tanks at the key U.S. storage hub, causing the spread between prompt and forward U.S. crude oil futures to slump to an 11-month low.

Traders fear that filling tanks to the brim could cause the next leg of a rout on distressed selling.

Meanwhile, Iran is aiming for crude exports of 2.3 million barrels per day in the coming fiscal year beginning on March 21, the managing director of the National Iranian Oil Company was quoted as saying on Tuesday.

That is higher than the 1.44 million bpd Iran is expected to export in February and 1.5 million bpd in January, according to data on Iran's preliminary tanker loading schedules.

Russia is ready to implement further cooperation in the oil market with OPEC and non-OPEC countries, Russian Foreign Minister Sergei Lavrov said on Tuesday while on a visit to Abu Dhabi.

Reference: Reuters